For the 24 hours to 23:00 GMT, the USD declined 0.53% against the JPY and closed at 111.74.

On the data front, Japan’s final leading economic index dropped less than initially estimated to a level of 105.2 in July. The index had recorded a level of 105.9 in the previous month, while the preliminary figures had recorded a fall to a level of 105.0. Further, the nation’s final coincident index dropped to a level of 115.7 in July, compared to a flash print indicating a fall to a level of 115.6. In the previous month, the coincident index had registered a reading of 117.1.

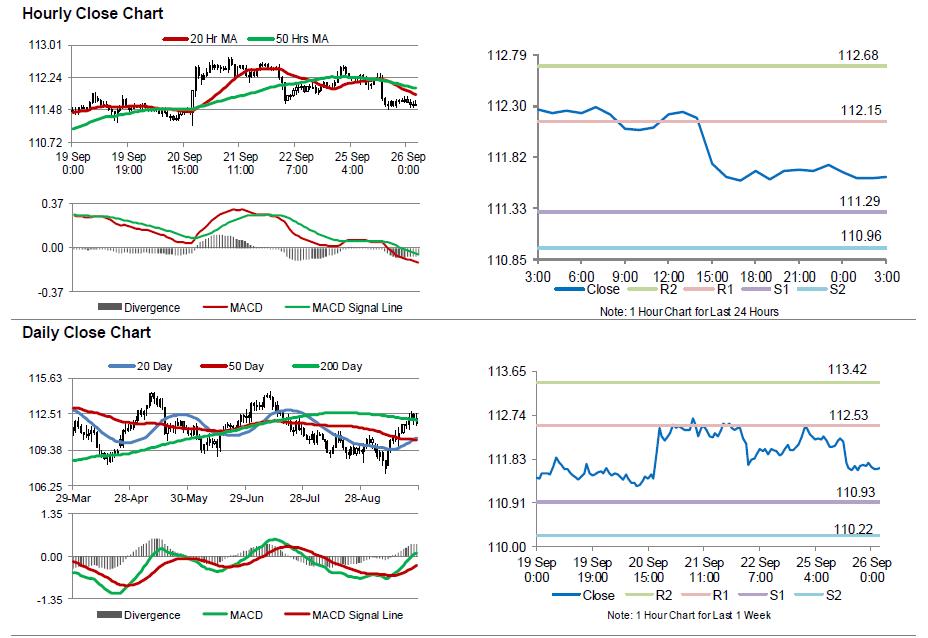

In the Asian session, at GMT0300, the pair is trading at 111.63, with the USD trading 0.1% lower against the JPY from yesterday’s close.

The Japanese Yen gained ground against the USD, as fresh threats from North Korea overnight boosted demand for the safe-haven currency.

Separately, minutes of the Bank of Japan’s (BoJ) July meeting showed that policymakers expressed confidence over achieving the central bank’s inflation target and reiterated the need to stick with their current policy framework despite the recent weakness in consumer inflation.

The pair is expected to find support at 111.29, and a fall through could take it to the next support level of 110.96. The pair is expected to find its first resistance at 112.15, and a rise through could take it to the next resistance level of 112.68.

Going ahead, traders await the release of Japan’s small business confidence index for September, slated to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.