For the 24 hours to 23:00 GMT, the USD marginally rose against the JPY and closed at 113.24.

In the Asian session, at GMT0400, the pair is trading at 113.16, with the USD trading 0.07% lower against the JPY from yesterday’s close.

According to the Bank of Japan’s (BoJ) latest summary of opinions report, some board members urged for a discussion over raising interest rates or lowering purchases of exchange-traded funds (ETF) in response to the improving economic fundamentals in the Japanese economy.

On the macro front, Japan’s seasonally adjusted retail trade climbed 1.9% MoM in November, compared to a revised fall of 0.1% in the prior month. Market participants had anticipated the retail trade to advance 0.7%. Moreover, the nation’s large retailers’ sales rebounded 1.4% in November, beating market expectations for an increase of 1.0% and compared to a drop of 0.7% in the preceding month.

Other data revealed that Japan’s preliminary industrial production grew 0.6% on a monthly basis in November, topping market consensus for an advance of 0.5%. In the previous month, industrial production had risen 0.5%.

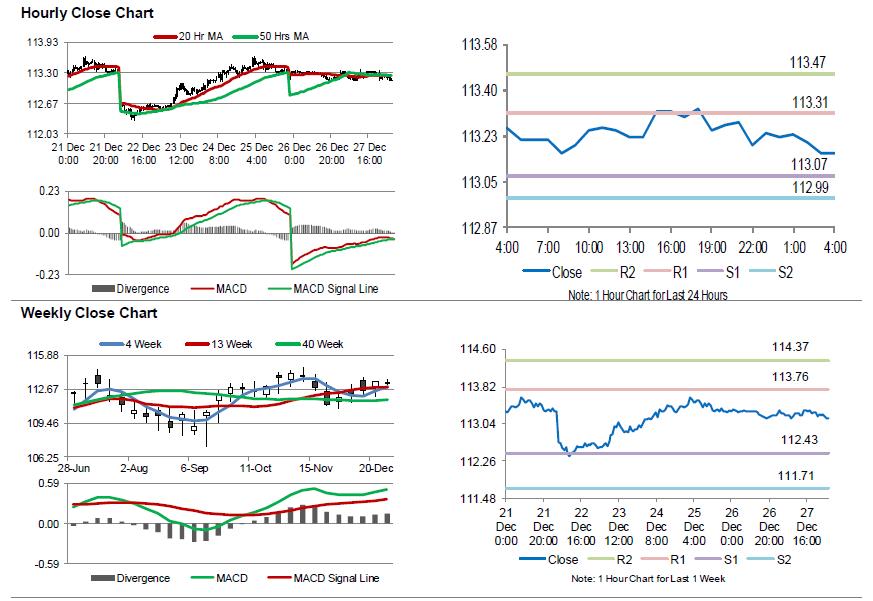

The pair is expected to find support at 113.07, and a fall through could take it to the next support level of 112.99. The pair is expected to find its first resistance at 113.31, and a rise through could take it to the next resistance level of 113.47.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.