For the 24 hours to 23:00 GMT, USD weakened 0.61% against the JPY and closed at 84.53.

In Japan, the Bank of Japan released the minutes from its March 14 policy meeting, showing concerns about the financial systems in the immediate aftermath of the earthquake, but also longer-term optimism. The meeting resulted in the bank expanding its asset-buying program by ¥5 trillion ($61 billion), to ¥40 trillion, among other steps.

In Japan, today morning, on yearly basis, the money supply rose to 2.7% in March from 2.4% recorded in the previous year.

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.82%, at 83.84.

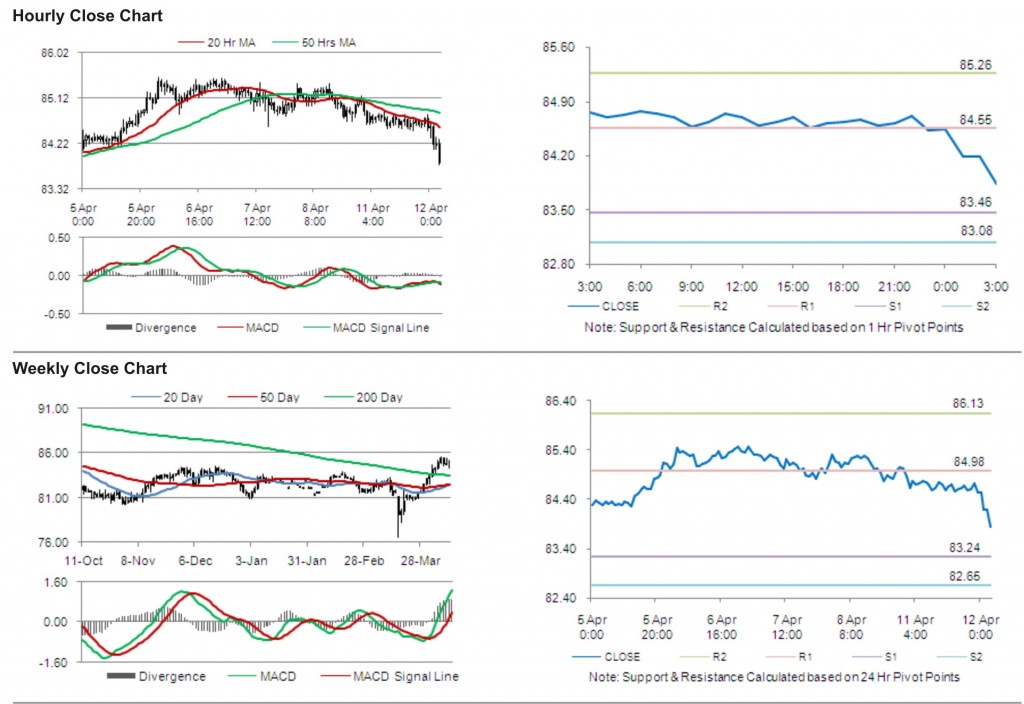

The first short term resistance is at 84.55, followed by 85.26. The pair is expected to find support at 83.46 and the subsequent support level at 83.08.

Trading trends in the pair today are expected to be determined by data release on machine tool orders and Domestic Corporate Goods Price Index in Japan.

The currency pair is trading well below its 20 Hr and 50 Hr moving averages.