For the 24 hours to 23:00 GMT, the USD weakened 0.52% against the JPY and closed at 101.13.

The safe haven appeal of the Japanese Yen rose on speculations of a terrorist attack on a Malaysian Airlines plane near the Russia/Ukraine border. Meanwhile, lacklustre equity markets also boosted the demand outlook of the Japanese Yen.

In the Asian session, at GMT0300, the pair is trading at 101.36, with the USD trading 0.23% higher from yesterday’s close.

Earlier today, the BoJ, in its minutes for the June policy meeting, indicated that majority of policymakers agreed that the central bank would continue with its stimulus measures as long as the nation does not achieve a price stability target of 2%. Furthermore, the policymakers insisted that the central bank should closely follow the effects of geopolitical risks posed by Ukraine and Iraq on the economy.

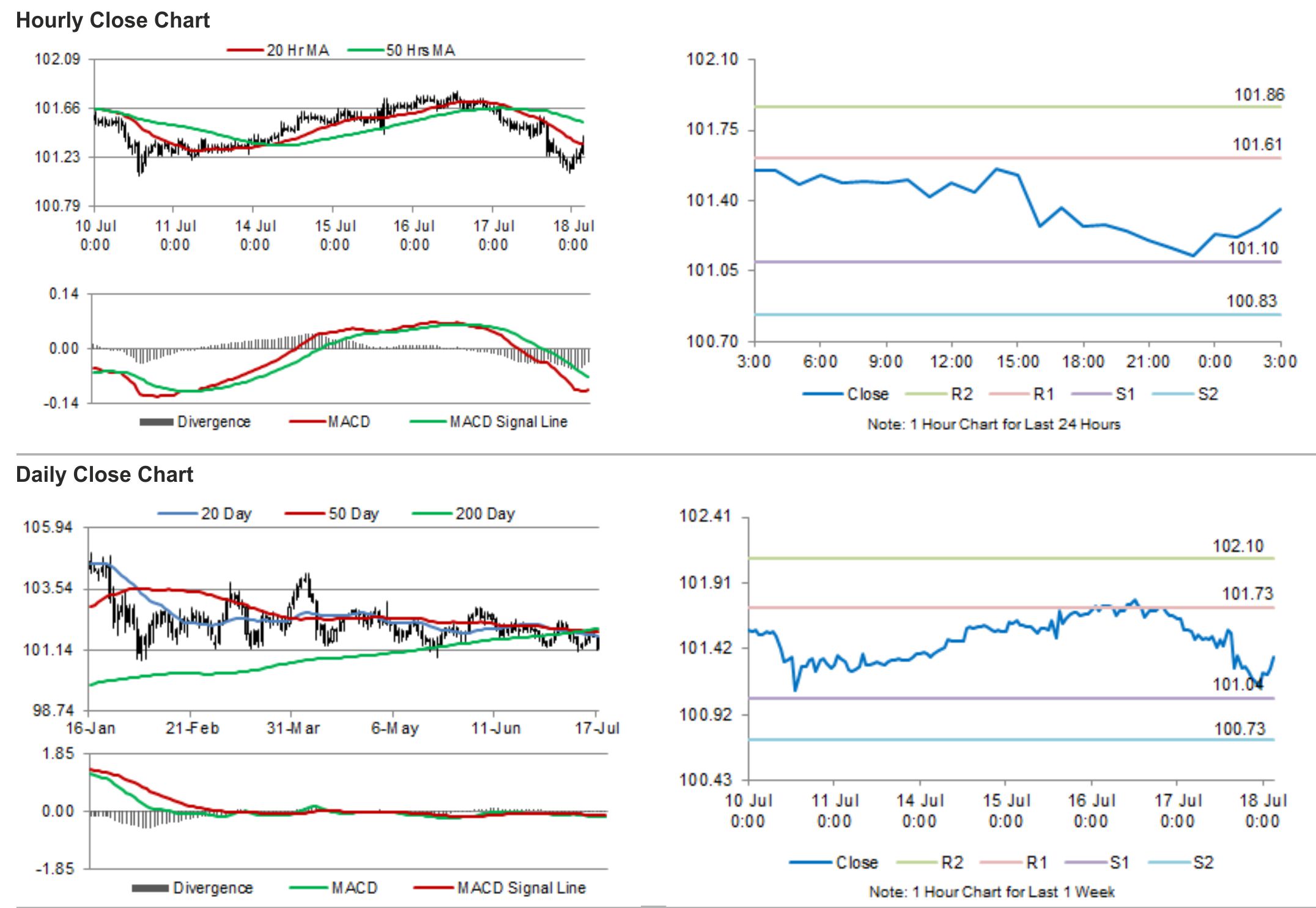

The pair is expected to find support at 101.1, and a fall through could take it to the next support level of 100.83. The pair is expected to find its first resistance at 101.61, and a rise through could take it to the next resistance level of 101.86.

Amid a lack of releases today, investors would pay attention to global news.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.