For the 24 hours to 23:00 GMT, the USD strengthened 0.79% against the JPY and closed at 118.66.

In the Asian session, at GMT0400, the pair is trading at 117.8, with the USD trading 0.72% lower from yesterday’s close.

Earlier today, the BoJ maintained its monetary stimulus programme at an annual pace of ¥80 trillion through purchases of government bonds and risky assets, in order to achieve its 2% inflation target. On the other hand, the central bank slashed its core consumer inflation estimation for this year to 1.0% from its earlier projection of 1.7%, citing continuous decline in global oil prices.

Data just released showed that Japan’s final leading economic index dropped to 103.9 in November, compared to a reading of 104.50 in the previous month, while the final coincident index eased to 109.2 in November. The coincident index had registered a level of 109.90 in the previous month

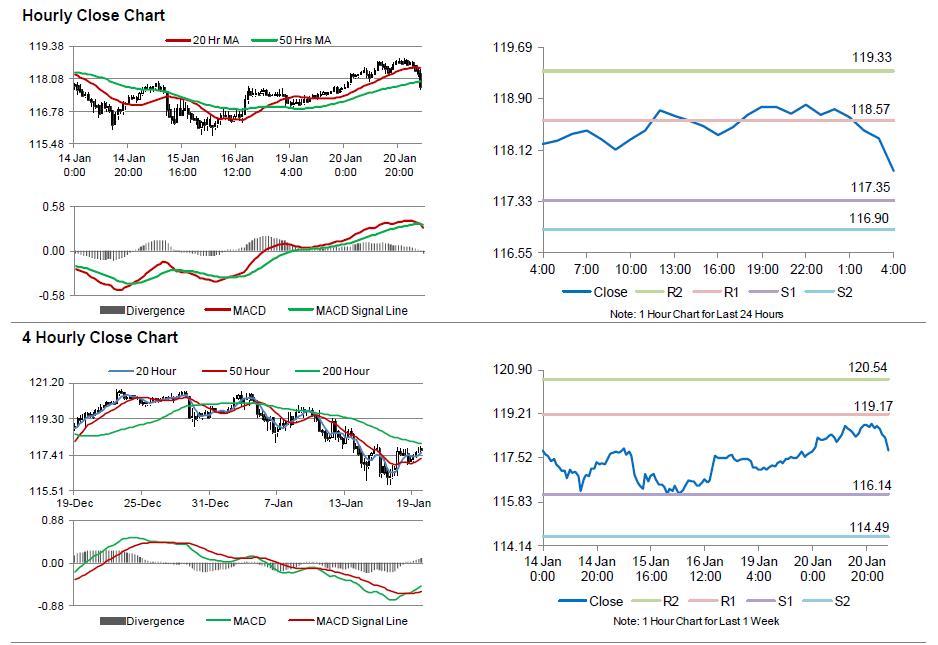

The pair is expected to find support at 117.35, and a fall through could take it to the next support level of 116.90. The pair is expected to find its first resistance at 118.57, and a rise through could take it to the next resistance level of 119.33.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.