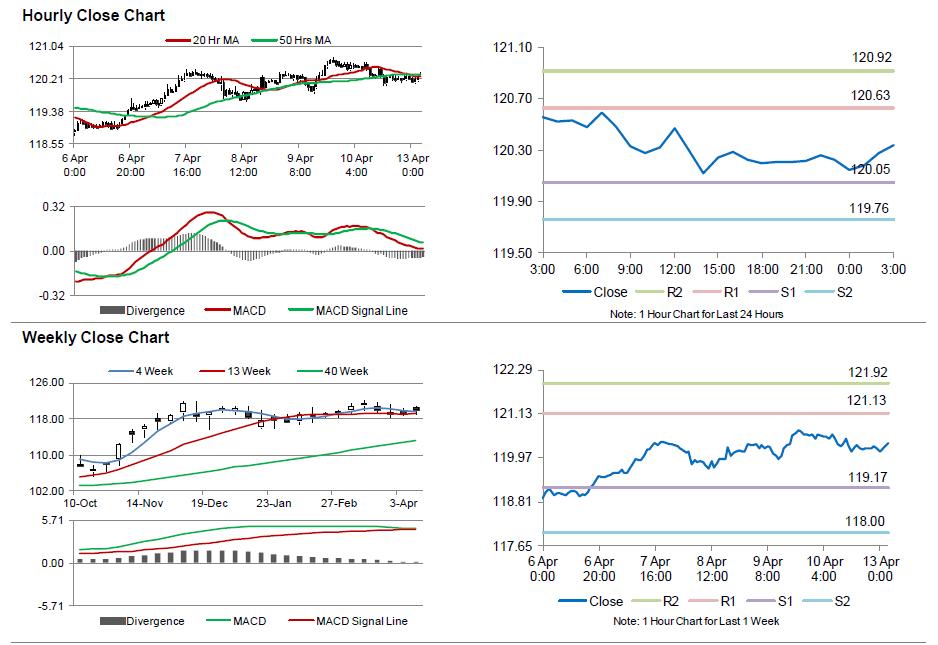

On Friday, the USD weakened 0.28% against the JPY and closed at 120.21.

In the Asian session, at GMT0300, the pair is trading at 120.34, with the USD trading 0.11% higher from Friday’s close.

Overnight data showed that Japan’s machine orders advanced 5.9% YoY in February, higher than market expected rise of 4.3% and compared to an increase of 1.9% recorded in January.

Separately, the BoJ minutes from its recent monetary policy meeting indicated that the central bank was confident over the nation’s moderate economic recovery and added that it will continue with its massive quantitative easing program at an annual pace of ¥80 trillion, as it was having positive impact on the Japanese economy.

The pair is expected to find support at 120.05, and a fall through could take it to the next support level of 119.76. The pair is expected to find its first resistance at 120.63, and a rise through could take it to the next resistance level of 120.92.

Meanwhile, investors would monitor Japan’s industrial production data, scheduled on Wednesday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.