For the 24 hours to 23:00 GMT, the USD weakened 0.08% against the JPY and closed at 124.70. The Yen rose on the back of positive macroeconomic data.

Japan’s preliminary leading economic index advanced to 107.20 in June, while the preliminary coincident index rose to a level of 112.00 in in the same month. Meanwhile, BoJ kept its monetary policy steady and reiterated its view that inflation would reach its 2% target without any extra stimulus boost.

In the Asian session, at GMT0300, the pair is trading at 124.78, with the USD trading 0.06% higher from yesterday’s close. The Yen lost ground after BoJ announced no changes in its monetary policy, keeping its interest rate unchanged at 0.1% and pledged to increase monetary base at annual pace of 80 trillion yen.

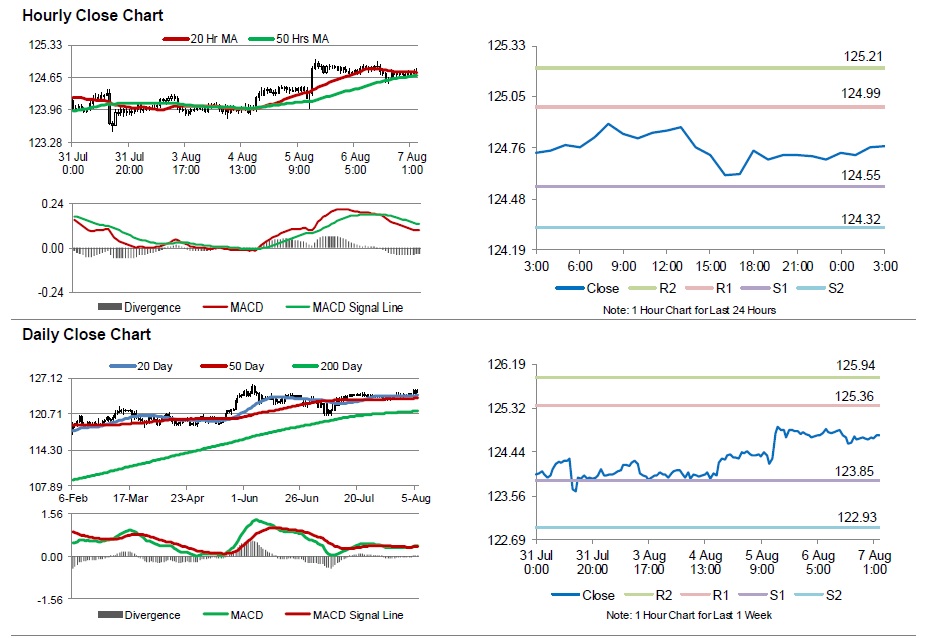

The pair is expected to find support at 124.55, and a fall through could take it to the next support level of 124.32. The pair is expected to find its first resistance at 124.99, and a rise through could take it to the next resistance level of 125.21.

Going ahead, investors would now keenly await for the Governor Kuroda’s press conference, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above 50 Hr moving average.