For the 24 hours to 23:00 GMT, the USD rose 0.5% against the JPY and closed at 105.64.

In the Asian session, at GMT0400, the pair is trading at 105.18, with the USD trading 0.44% lower against the JPY from yesterday’s close.

As per the Bank of Japan’s (BoJ) latest summary of opinions report, released overnight, not all policymakers doubted that inflation would reach its 2.0% target within its projection period, partially because of a vigilant outlook on inflation expectations. Further, the BoJ has predicted the year-on-year consumer price index to reach its 2.0% target around fiscal 2018.

In other economic news, Japan’s flash machinery orders eased more-than-expected by 3.3% on a monthly basis in September, following a drop of 2.2% in the prior month.

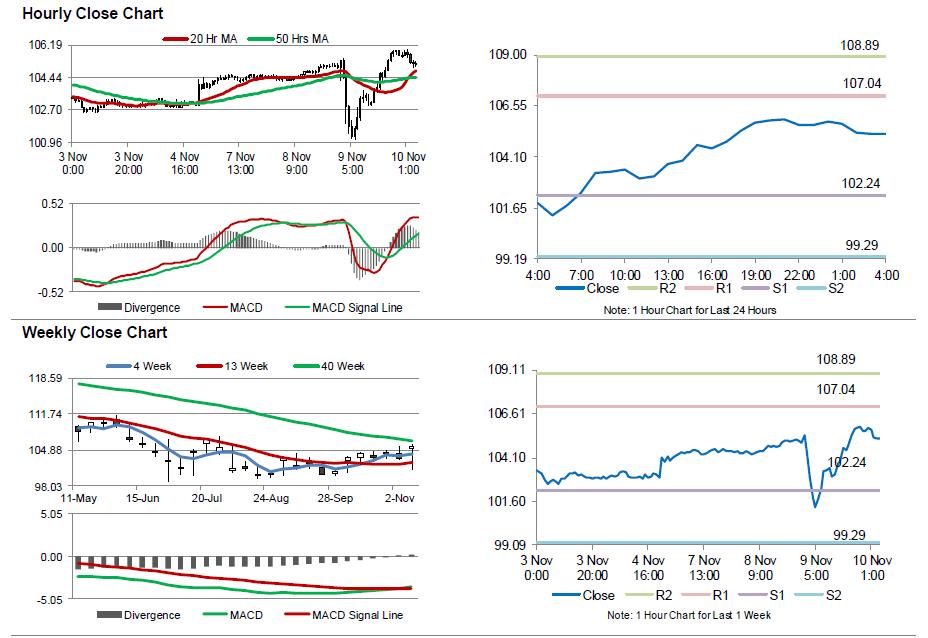

The pair is expected to find support at 102.24, and a fall through could take it to the next support level of 99.29. The pair is expected to find its first resistance at 107.04, and a rise through could take it to the next resistance level of 108.89.

Moving ahead, investors would concentrate on Japan’s final machine tool orders for October and tertiary industry index for September, due to release tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.