For the 24 hours to 23:00 GMT, USD weakened 0.41% against the JPY and closed at 80.32.

Data released in Japan showed that the consumer confidence index climbed to 35.3 in June, from 34.2 in May. Also, the Japan Machine Tool Builders’ Association reported that the machine tool orders in Japan increased 53.3% Y-o-Y to ¥128.3 billion in June.

This morning, Japan’s corporate goods price index rose 2.5% from a year earlier in June, the ninth consecutive rise. Additionally, tertiary industry activity in Japan was up a seasonally adjusted 0.9% in May.

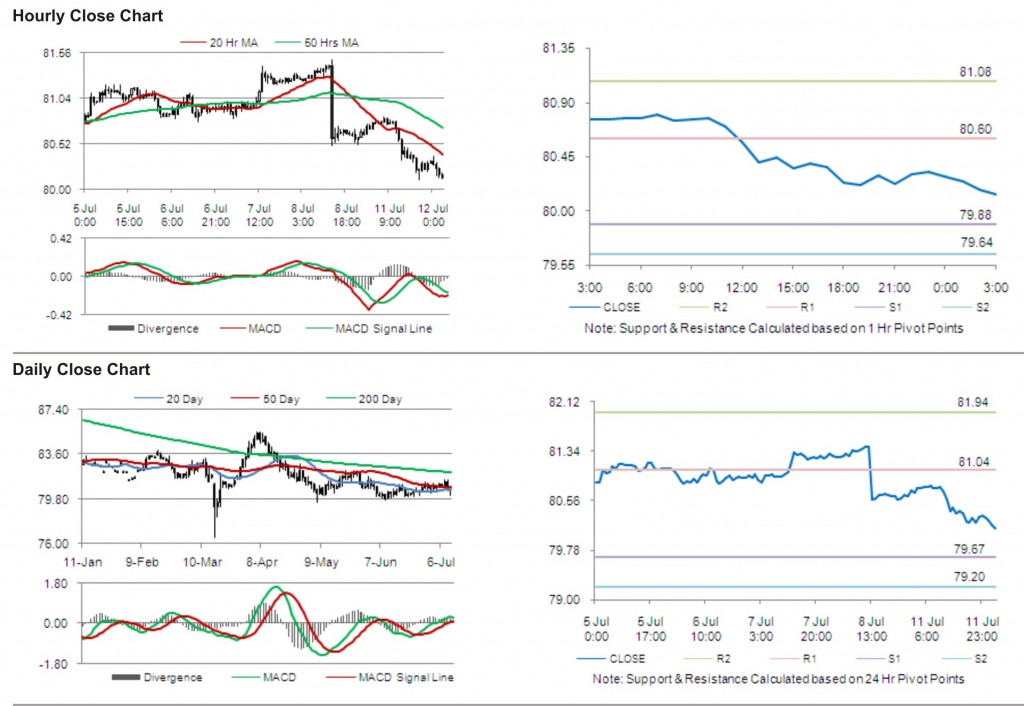

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.24%, at 80.13.

The first short term resistance is at 80.60, followed by 81.08. The pair is expected to find support at 79.88 and the subsequent support level at 79.64.

Investors are eying Bank of Japan’s interest rate decision to be released later today.

The pair is trading below its 20 Hr and 50 Hr moving averages.