On Friday, the USD strengthened 0.18% against the JPY and closed at 101.79.

On the economic front, Japan’s leading economic index fell more-than-expected to a 12-month low reading of 106.5 in March while its coincident index improved to level of 114.0 in March from previous month’s reading of 112.9.

In the Asian session, at GMT0300, the pair is trading at 101.98, with the USD trading 0.19% higher from Friday’s close.

Early morning, official data from Japan revealed that trade deficit widened to ¥1,133.6 billion in March, compared to a deficit of ¥533.4 billion in the previous month, while Japan’s current account posted its smallest surplus of ¥116.4 billion in March. Separately, the BoJ reported that bank lending in the nation rose 2.1% (YoY) to ¥476.6 trillion in April, compared to a similar pace of rise in March.

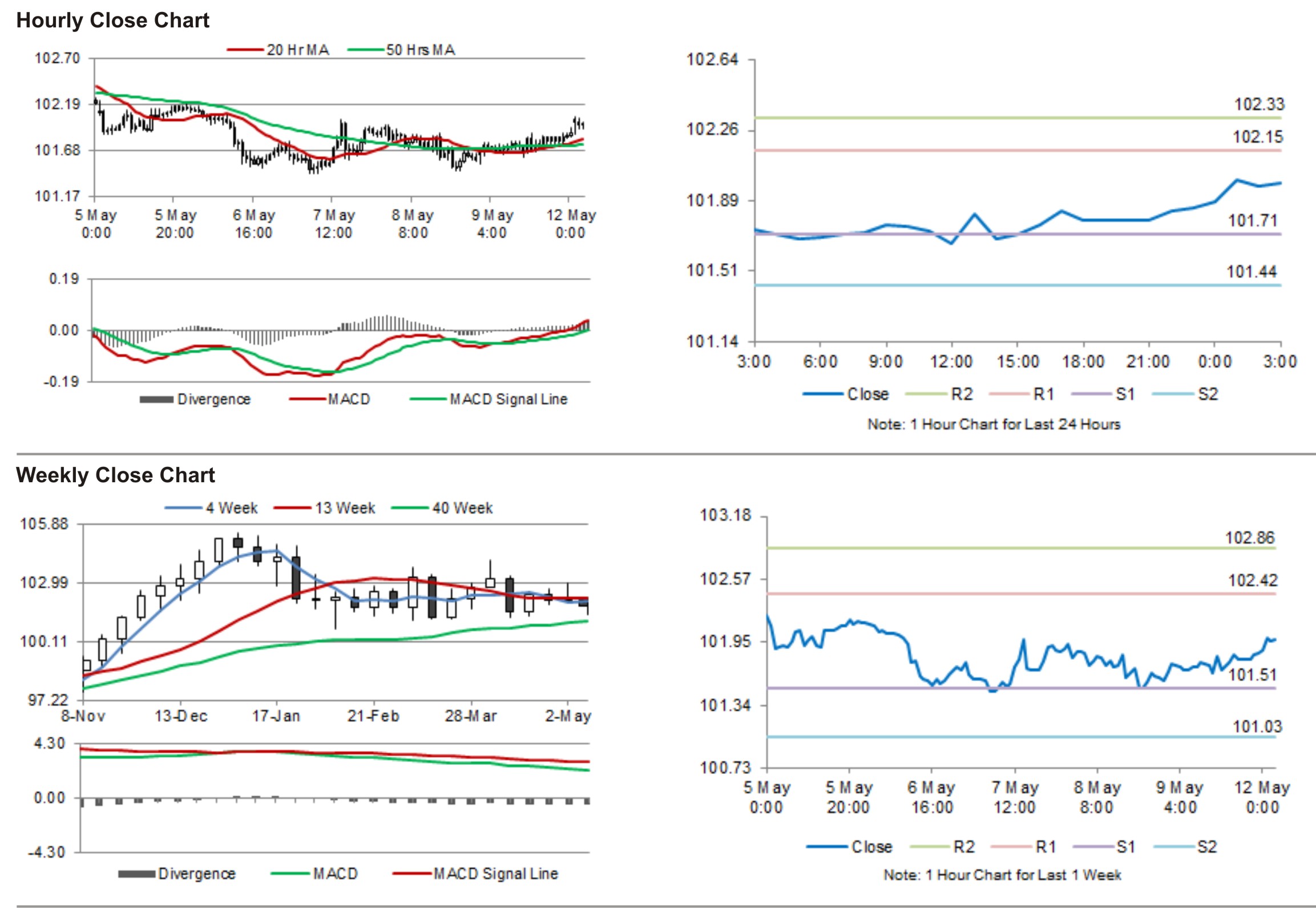

The pair is expected to find support at 101.71, and a fall through could take it to the next support level of 101.44. The pair is expected to find its first resistance at 102.15, and a rise through could take it to the next resistance level of 102.33.

Later today, Japan’s Cabinet Office is scheduled to release a report on its Eco watchers survey on the nation’s current economic situation and its short-term outlook.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.