For the 24 hours to 23:00 GMT, USD strengthened 0.27% against the JPY and closed at 77.43, after speculation that the Japanese government would intervene in the currency market.

Japan’s Nikkei newspaper reported that Japan’s government was planning to intervene to stop recent gains in the Yen and that the Bank of Japan might start easing monetary policy, which would assist in weakening the yen.

In economic news, this morning, the monetary base in Japan was up 15.0% (Y-o-Y) in July, following a 17.0% annual expansion in June. Additionally, the labor cash earnings declined 0.8% (Y-o-Y) in June, compared to a 1% rise in the previous month.

In the Asian session at 3:00GMT, the pair is trading flat from yesterday’s close at 23:00 GMT, at 77.44.

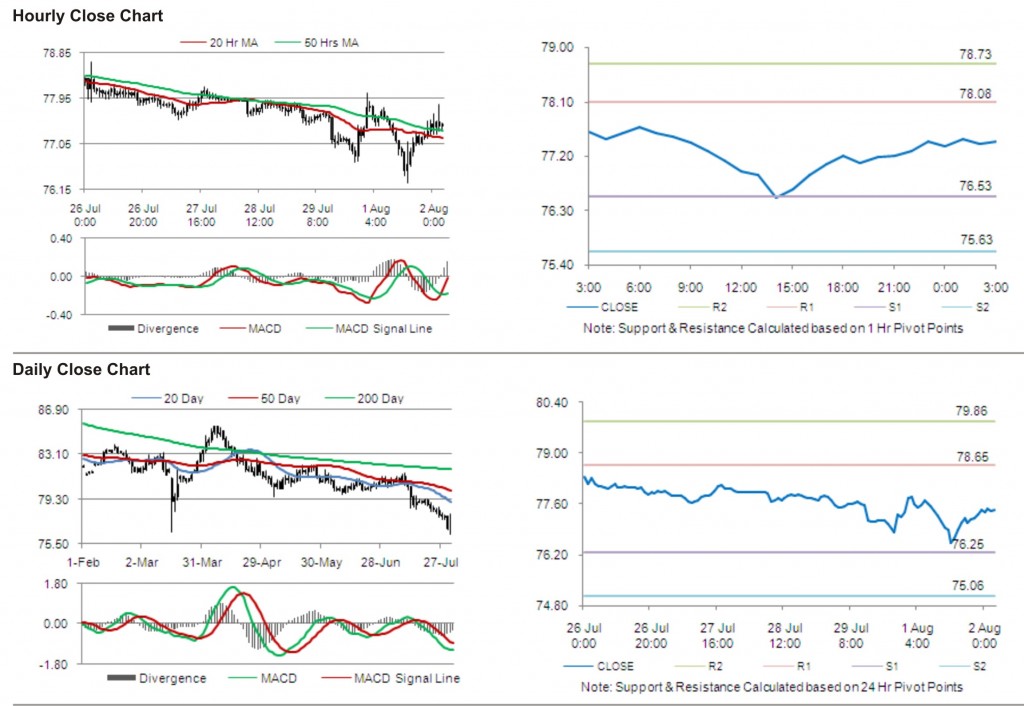

The first short term resistance is at 78.08, followed by 78.73. The pair is expected to find support at 76.53 and the subsequent support level at 75.63.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.