For the 24 hours to 23:00 GMT, the USD rose 0.4% against the JPY and closed at 125.06. The Yen lost ground after preliminary figures reported that machine tool orders in Japan rose only 1.60% YoY in July, after recording a 6.60% advance in the previous month.

In the Asian session, at GMT0300, the pair is trading at 125.22, with the USD trading 0.13% higher from yesterday’s close.

Earlier today, minutes from the BoJ’s policy meeting conducted on July 14 and 15 indicated that Japan’s economic recovery remains on track. However, the minutes showed worries that the slowdown in China could hurt Japan’s exports.

In other economic news, Japan’s domestic corporate goods price index in July decreased 0.20% MoM, higher than market expectations for a fall of 0.10%. Meanwhile, the nation’s Japan’s final industrial production rose 2.30% YoY in June vs. preliminary figures recording an advance of 2.00%. The tertiary industry index in Japan climbed 0.30% MoM in June on a monthly basis, compared to a revised fall of 0.60% in the prior month. The tertiary industry index in Japan climbed 0.30% MoM in June on a monthly basis, compared to a revised fall of 0.60% in the prior month.

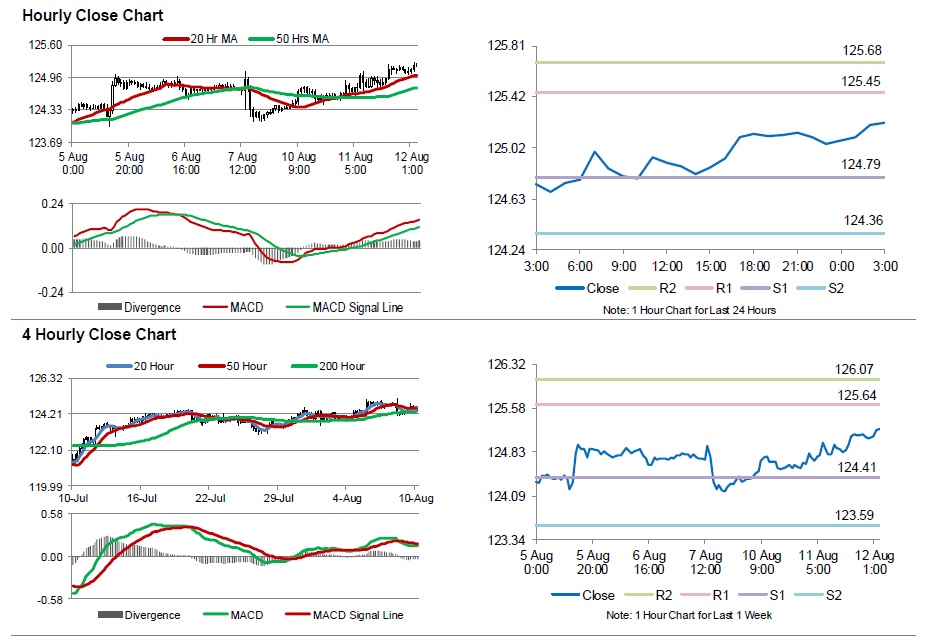

The pair is expected to find support at 124.79, and a fall through could take it to the next support level of 124.36. The pair is expected to find its first resistance at 125.45, and a rise through could take it to the next resistance level of 125.68.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.