For the 24 hours to 23:00 GMT, the USD strengthened 0.23% against the JPY and closed at 101.54. The Japanese Yen lost ground after the BoJ’s Tankan survey highlighted a lack of confidence among Japanese business. Also, the latest batch of strong manufacturing PMI data from China, the world’s second largest economy, dampened demand for the safe-haven Yen.

In the Asian session, at GMT0300, the pair is trading at 101.61, with the USD trading 0.06% higher from yesterday’s close.

Early morning, an official report revealed that monetary base in Japan advanced 42.6% (YoY) in June to ¥233.246 trillion, following a 45.6% rise in May.

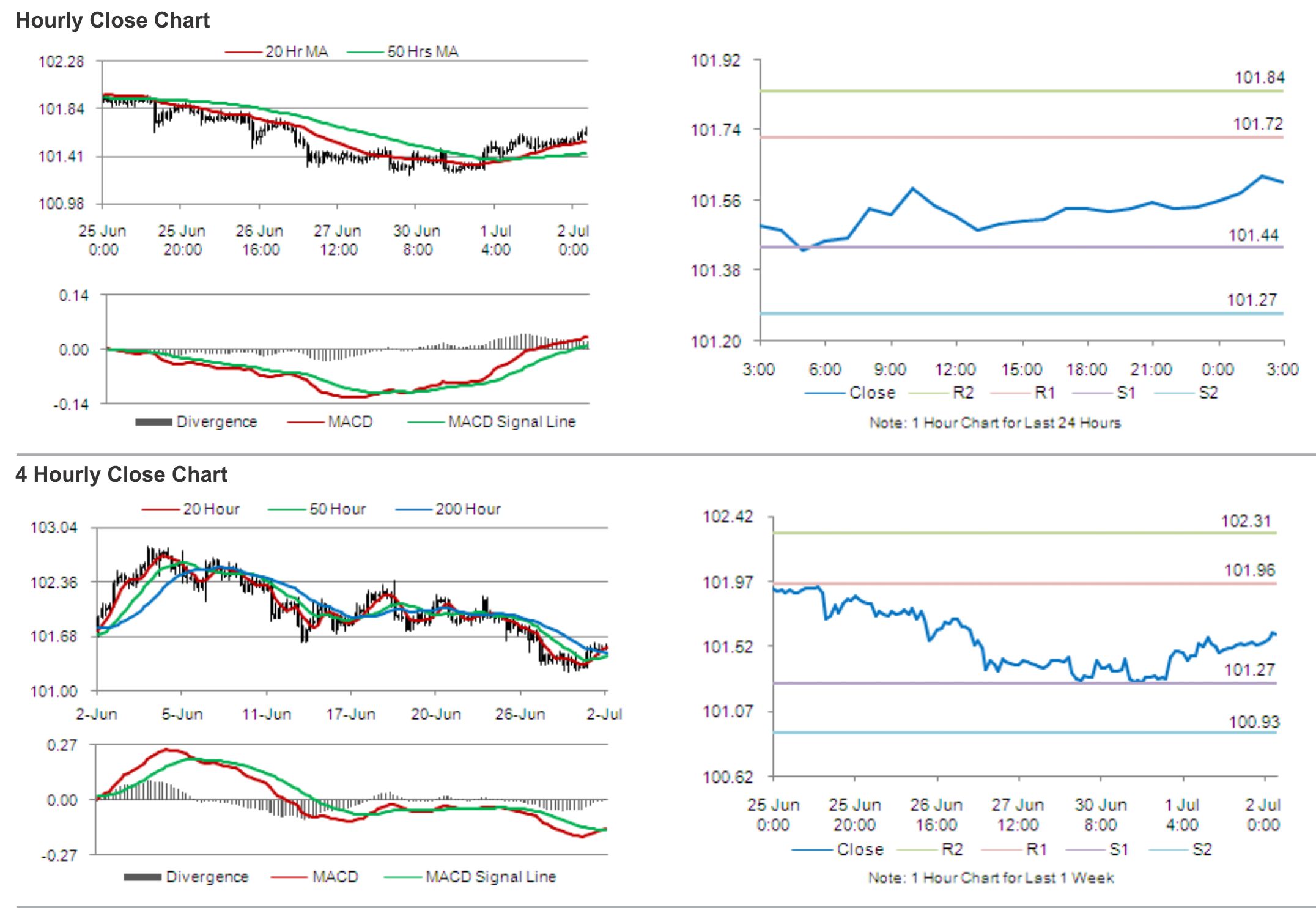

The pair is expected to find support at 101.44, and a fall through could take it to the next support level of 101.27. The pair is expected to find its first resistance at 101.72, and a rise through could take it to the next resistance level of 101.84.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.