For the 24 hours to 23:00 GMT, the USD strengthened 0.41% against the JPY and closed at 103.64.

In the Asian session, at GMT0300, the pair is trading at 103.86, with the USD trading 0.21% higher from yesterday’s close.

Earlier today, a survey from the Bank of Japan, showed that Japanese companies forecasted inflation rate in the nation to rise to 1.5% in the next year, and to a modest 1.7% over the next three years and five years from now, thereby indicating that the BoJ’s two-year plan to achieve 2% target would need more determination and additional measures from the central bank as the survey clearly suggests that the objective seems to be overly ambitious. Separately, the central bank also reported that monetary base in Japan spiked 54.8% (YoY) in March, following a 55.7% surge in the previous month.

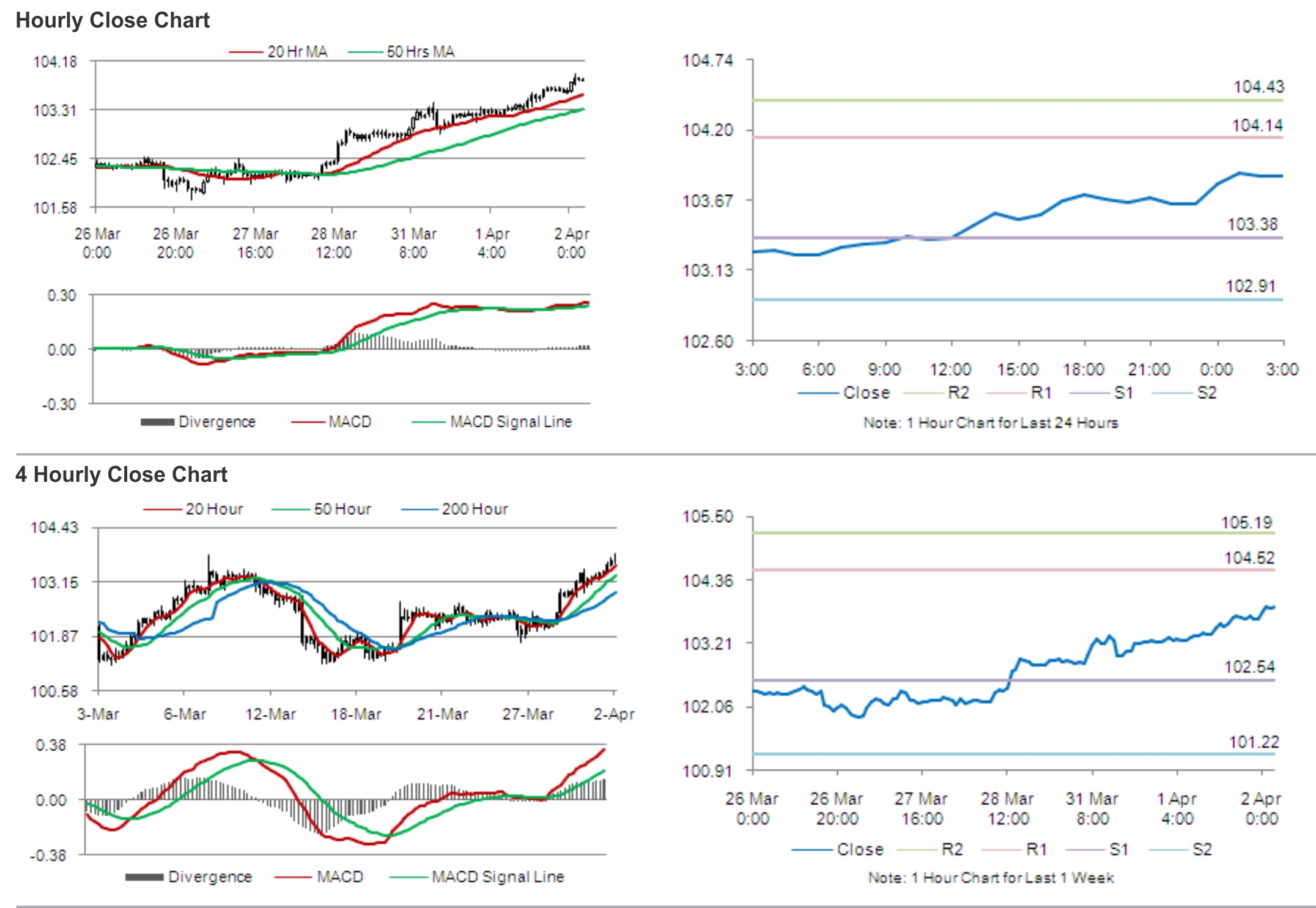

The pair is expected to find support at 103.38, and a fall through could take it to the next support level of 102.91. The pair is expected to find its first resistance at 104.14, and a rise through could take it to the next resistance level of 104.43.

Later during the day, Markit service PMI data for Japan would fetch traders’ maximum attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.