For the 24 hours to 23:00 GMT, the USD strengthened 0.55% against the JPY and closed at 102.67.

The demand for the greenback continued to be underpinned as expectations for more stimulus cuts at the upcoming Federal Open Market Committee (FOMC)’s meeting this week, which is scheduled to be held on January 28-29.

The US Dollar gained momentum after data indicated that the increased to a level of 56.6 in January from 55.7 the previous month, exceeding market expectations of 56.2, thereby rising to its highest level since September 2013. Moreover, the Federal Reserve Bank of Dallas’s manufacturing business index unexpectedly rose to a reading of 3.8 in January, compared to a level of 3.7 reported in the preceding month. Market had expected the manufacturing activity index to fall to a reading of 3.3 in January.

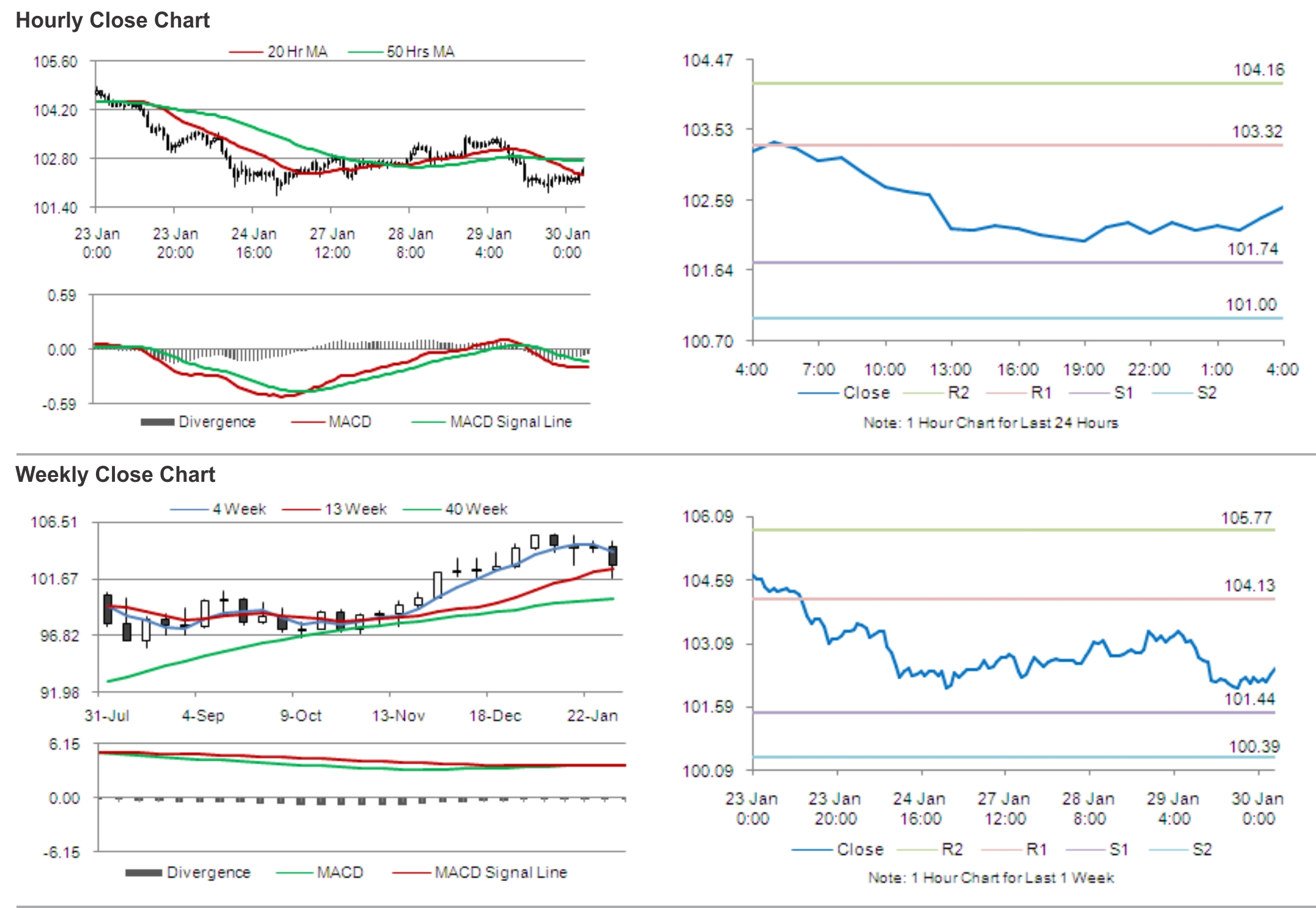

In the Asian session, at GMT0400, the pair is trading at 102.66, with the USD trading tad lower from yesterday’s close.

This morning, on the macro front, the Bank of Japan (BoJ) reported that the corporate service price index in Japan increased 1.3% in December, following a revised rise of 1.2% recorded in November. Market had expected the index to increase 1.1% in December.

Separately, the Small Business Confidence in Japan rose to a reading of 51.3 in January from a reading of 51.1 posted in the previous month.

The pair is expected to find support at 102.25, and a fall through could take it to the next support level of 101.85. The pair is expected to find its first resistance at 103.01, and a rise through could take it to the next resistance level of 103.36.

Amid lack of economic data in Japan, trading trends in the pair today are expected to be determined by the US Durable goods order data, consumer confidence data and the Richmond Fed manufacturing index.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.