For the 24 hours to 23:00 GMT, USD strengthened 0.23% against the JPY and closed at 77.50.

In Japan, yesterday, the economic watchers outlook index dropped to a reading of 47.1 in August, following a reading of 48.5 posted in July. Additionally, the current conditions index slipped to a reading of 47.3 in August, compared to a reading of 52.6 posted in July. Additionally, this morning, the gross domestic product declined to 0.5% in the second quarter of 2011 from 0.3% in the previous quarter. The money stock rose 2.7% (M-o-M) in August following a 3.0% rise in July.

Separately, Japan’s Finance Minister stated that he would inform top finance officials from the Group of Seven leading industrialised nations about his intention to intervene in the currency market if he spotted “excessive” speculation bolstering the yen.

In the Asian session at 3:00GMT, the dollar is flat against yen from yesterday’s close at 23:00 GMT, at 77.49.

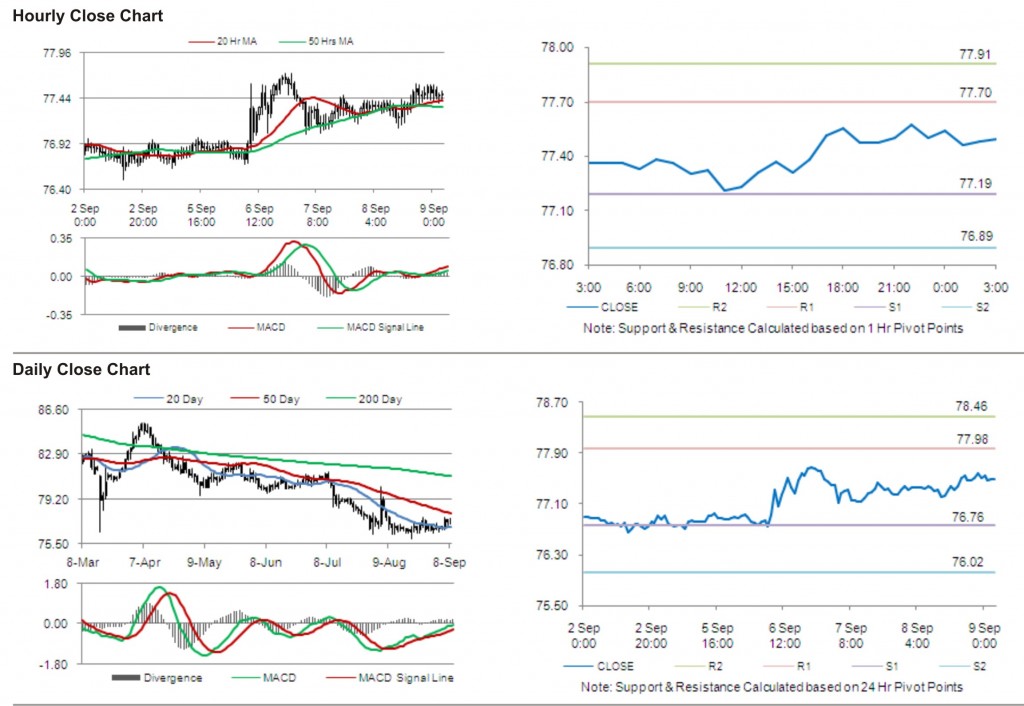

The first short term resistance is at 77.70, followed by 77.91. The pair is expected to find support at 77.19 and the subsequent support level at 76.89.

Trading trends in the pair today are expected to be determined by release of Consumer Confidence Index in Japan.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.