For the 24 hours to 23:00 GMT, USD weakened 0.43% against the JPY and closed at 76.59.

In the US, the homebuilder confidence index dropped to 14.0 in September, compared to 15.0 in August.

This morning, in a monthly report, the Japanese government maintained its view that the country’s economy has continued to pick up recently, but stated that the continuing impact of the March 11 disasters, the rising yen and weakening overseas demand are all weighing on the nation’s slow recovery.

In the Asian session at 3:00GMT, the dollar is trading lower against yen from yesterday’s close at 23:00 GMT, by 0.13%, at 76.49.

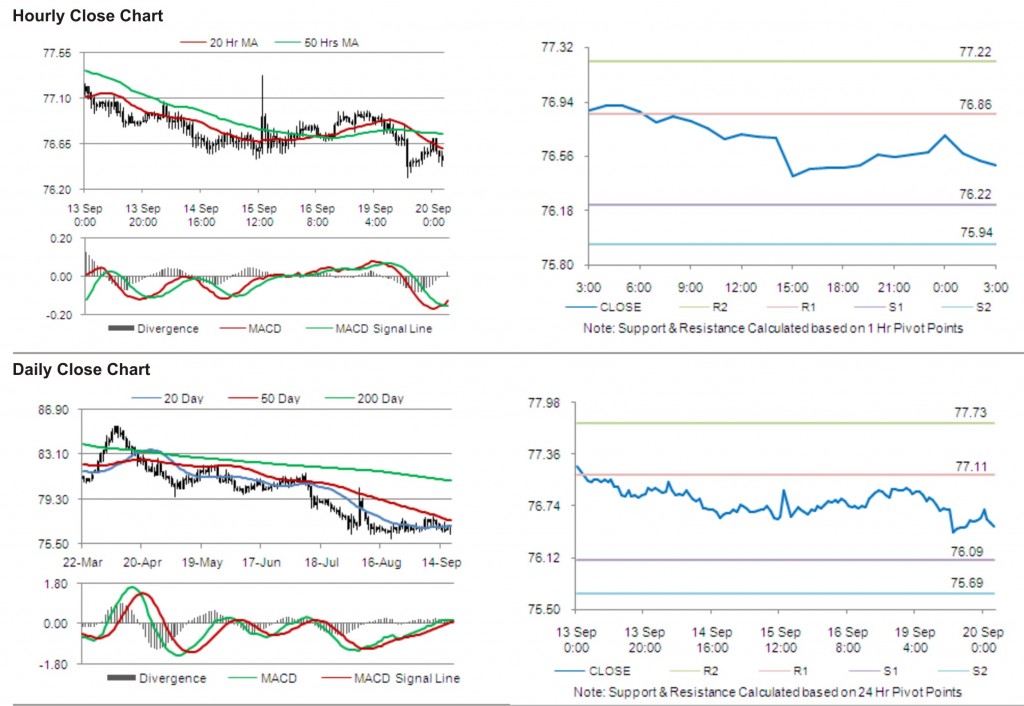

The first short term resistance is at 76.86, followed by 77.22. The pair is expected to find support at 76.22 and the subsequent support level at 75.94.

With a series of Japan economic releases today, including Leading Economic Index and trade balance, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.