For the 24 hours to 23:00 GMT, the USD strengthened 0.95% against the JPY and closed at 102.44, after the US Fed trimmed its asset-purchase programme by another $10 billion and hinted the possibility for an interest rate hike by the mid of next year.

Meanwhile, in Japan, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, reiterated his earlier view that the Japanese economy is on track to meet its 2% inflation target and confirmed that “the central bank would examine both upside and downside risks to economic activity and prices, and make adjustments if necessary to achieve the price stability target.” Separately, another BoJ member, Takehiro Sato opined that he saw no immediate need for an additional stimulus measure in the economy as, according to him the economy is far more capable to withstand a rise in the sales tax as compared to what it was during a previous sales tax hike in 1997. However, an ex-BoJ Deputy Governor, Toshiro Muto, dissented to the former’s view and forecasted a probability for an additional stimulus measure as early as April-June and at the latest in July-September, in order to boost growth and stoke moderate inflation in the economy.

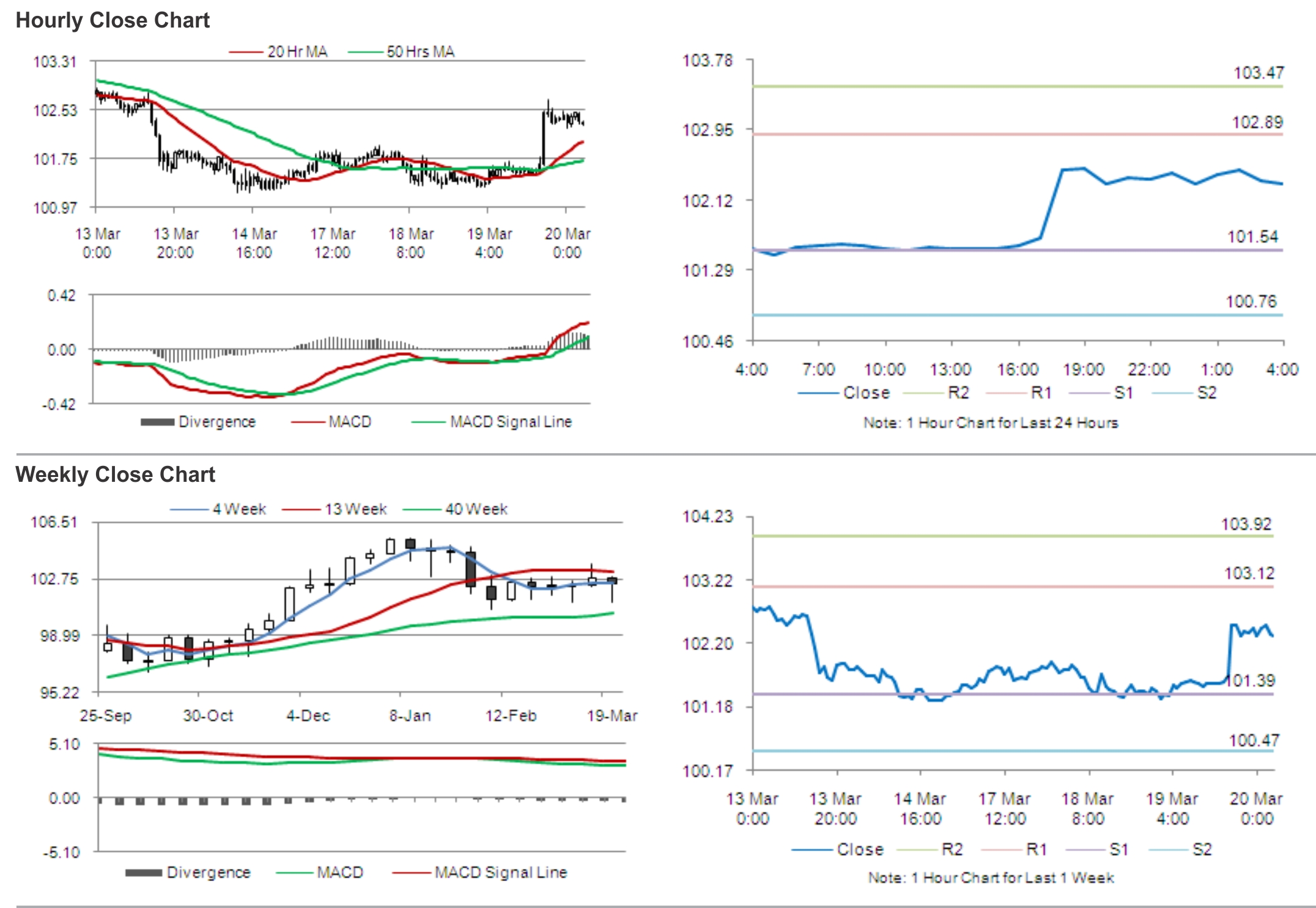

In the Asian session, at GMT0400, the pair is trading at 102.31, with the USD trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 101.54, and a fall through could take it to the next support level of 100.76. The pair is expected to find its first resistance at 102.89, and a rise through could take it to the next resistance level of 103.47.

Market participants keenly await the BoJ Governor, Haruhiko Kuroda’s speech on the central bank’s monetary policies, expected to commence later today in Tokyo.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.