For the 24 hours to 23:00 GMT, USD traded flat against the JPY and closed at 81.70, amid release of Japanese gross domestic product which showed that the economy sank more than projected.

In Japan, yesterday, the capacity utilization declined 21.5% in March from 2.9% in the previous month, industrial production declined by 15.5% in March compared to decline of 15.3% in the previous month. Additionally, the Japan Department Stores Association reported that, on an annual basis, the nationwide department store sales declined 1.5% in April, following a 14.7% drop recorded in the previous month.

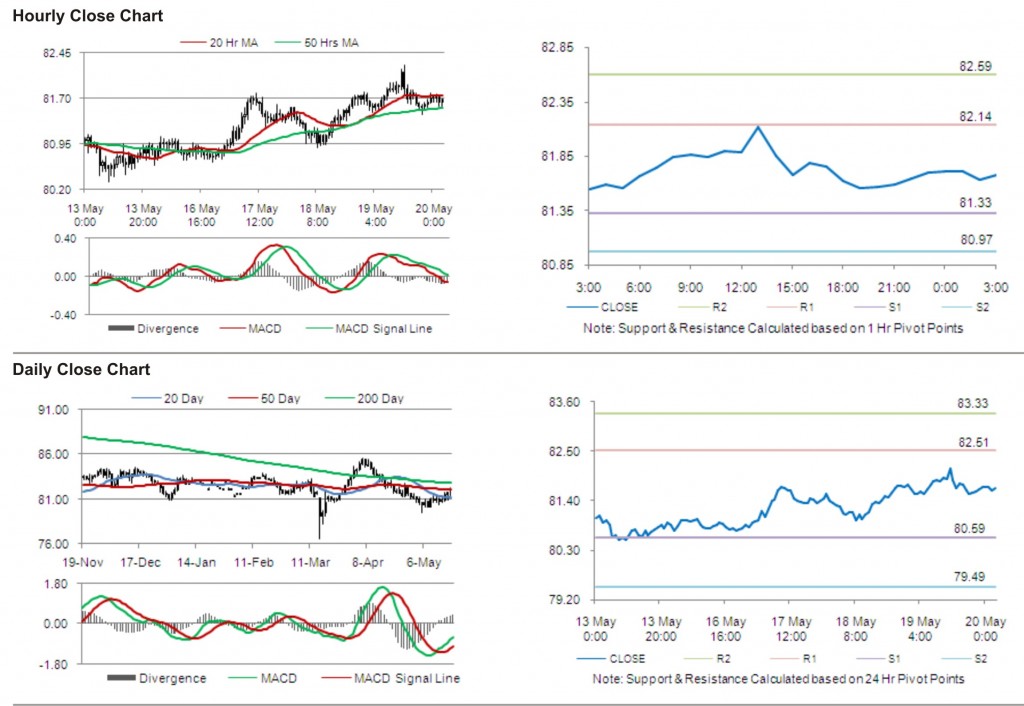

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.02% at 81.68.

The first short term resistance is at 82.14, followed by 82.59. The pair is expected to find support at 81.33 and the subsequent support level at 80.97.

Investors are eying BoJ interest rate decision along with other economic releases in the Japan to be released later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.