For the 24 hours to 23:00 GMT, the USD declined 0.35% against the JPY and closed at 123.47.

In the Asian session, at GMT0300, the pair is trading at 122.88, with the USD trading 0.48% lower from yesterday’s close, after Japan’s manufacturing PMI grew at fastest pace in seven months in July.

The preliminary Japan manufacturing PMI rose to 51.9 in August, from 51.2 in July, on the nation’s rising domestic orders this month.

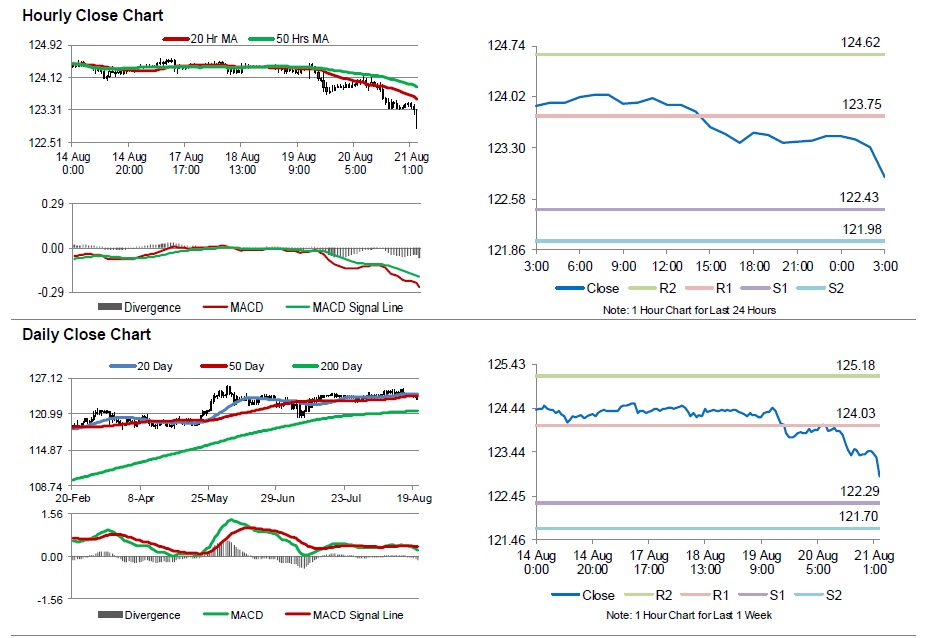

The pair is expected to find support at 122.43, and a fall through could take it to the next support level of 121.98. The pair is expected to find its first resistance at 123.75, and a rise through could take it to the next resistance level of 124.62.

In the coming week, Japan’s consumer prices data for July, would grab a lot of attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.