For the 24 hours to 23:00 GMT, USD traded flat against the JPY and closed at 78.30.

Bank of Japan Governor, Masaaki Shirakawa stated yesterday that recent yen rises could hurt the country’s economic outlook by undermining exports and corporate sentiment. He further added that Europe’s sovereign risks and mounting tensions in the US debt talks have left open the possibility of a sharp rise in global bond yields, which would severely hurt advanced nations with worsening finances.

Additionally in the morning economic news in Japan, the corporate service price declined by 0.7% (Y-o-Y) in June, from a 0.9% decline in the previous month.

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.20%, at 78.14.

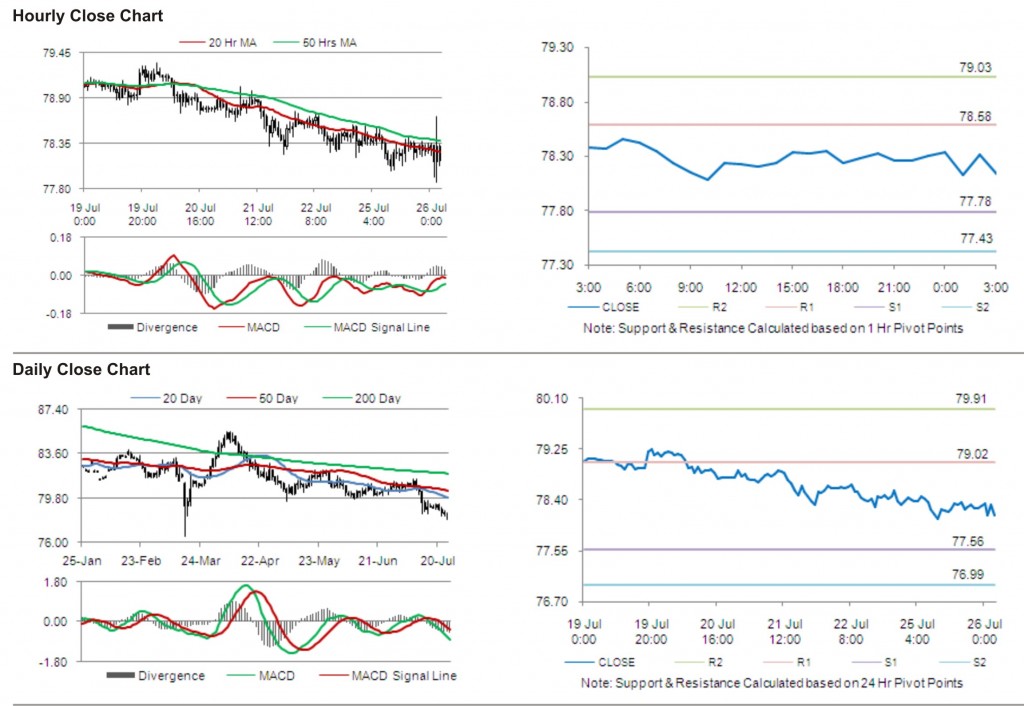

The first short term resistance is at 78.58, followed by 79.03. The pair is expected to find support at 77.78 and the subsequent support level at 77.43.

The pair is expected to trade on the cues from the release of data on small business confidence in Japan.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.