For the 24 hours to 23:00 GMT, the USD marginally weakened against the JPY and closed at 102.81.

Yesterday, the IMF urged Japan to continue implementing economic reforms in the nation as failure to do so would endanger Japan’s financial stability. It further added that currently the Japanese Yen is “at fair values against the other major currencies.”

On the economic front, housing starts in Japan declined 9.5% in June on an annual basis, compared to a 15.0% fall recorded in the previous month. Markets were expecting housing starts to fall 11.5% in June. Separately, construction orders in Japan rose 9.3% in June on a yearly basis, compared to a 13.7% rise in the previous month.

In the Asian session, at GMT0300, the pair is trading at 102.89, with the USD trading 0.08% higher from yesterday’s close.

The Japanese Yen weakened after the final manufacturing Purchasing Managers’ Index (PMI) in Japan fell to a reading of 50.5 in July, compared to a final reading of 51.5 reported in the previous month.

Earlier this morning, BoJ Governor Haruhiko Kuroda indicated that the central bank’s easing program is having its intended effect, further assuring that the BoJ would adjust its policy if required in the future.

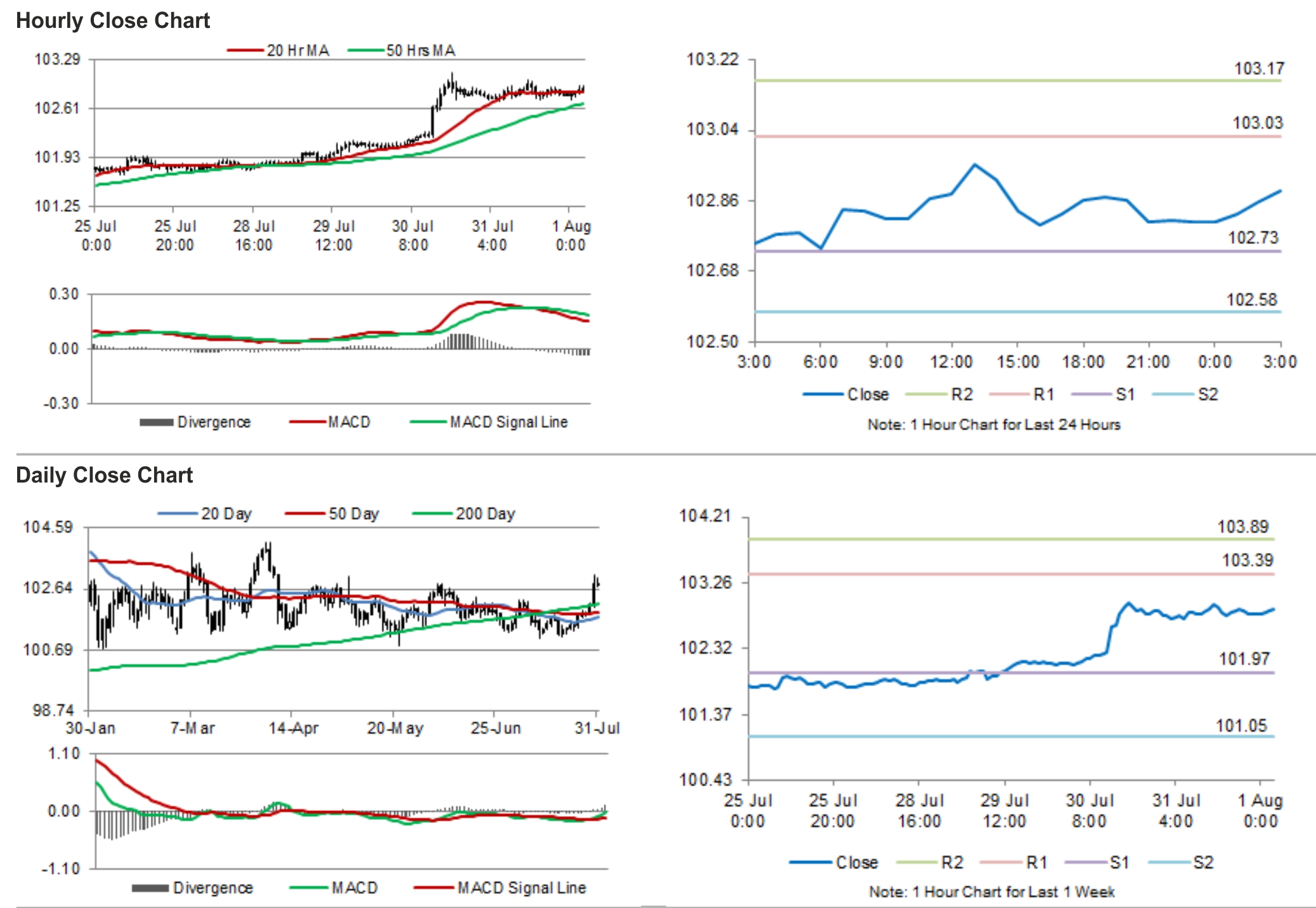

The pair is expected to find support at 102.73, and a fall through could take it to the next support level of 102.58. The pair is expected to find its first resistance at 103.03, and a rise through could take it to the next resistance level of 103.17.

Trading trends in the pair today are expected to be determined by external factors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.