For the 24 hours to 23:00 GMT, the USD strengthened 0.09% against the JPY and closed at 118.26.

In economic news, Japan’s annual machine tool orders registered a rise of 30.8% in October, compared to a rise of 31.2% registered in the prior month.

Yesterday, the BoJ in its monthly economic survey indicated that the Japanese economy has continued to recover moderately as a trend, although some weakness remain particularly on the production side.

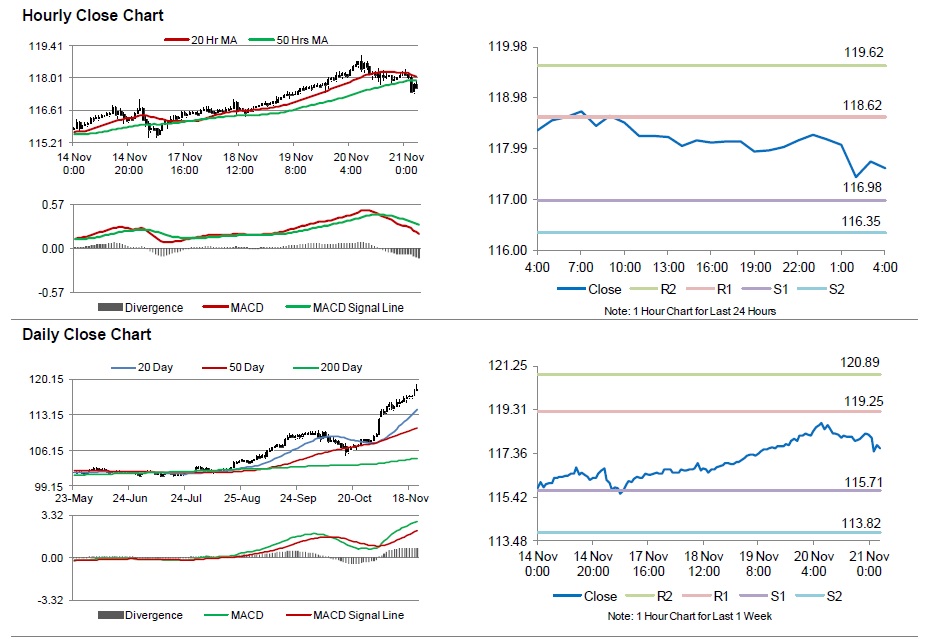

In the Asian session, at GMT0400, the pair is trading at 117.61, with the USD trading 0.55% lower from yesterday’s close.

Earlier today, a leading broker downgraded Japan’s GDP growth estimate to 0.3% from 0.9% for 2014 and from 1.0% to 0.6% for 2015 and further indicated that the BoJ would initiate additional stimulus in the 2015 fiscal.

The pair is expected to find support at 116.98, and a fall through could take it to the next support level of 116.35. The pair is expected to find its first resistance at 118.62, and a rise through could take it to the next resistance level of 119.62.

Looking ahead, markets await the BoJ’s minutes from its October monetary policy meeting, scheduled overnight on Monday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.