For the 24 hours to 23:00 GMT, USD strengthened 1.19% against the JPY and closed at 85.11, after minutes from the Federal Reserve’s March 15 meeting showed that some policy makers stated that signs of a stronger recovery may warrant a less-accommodative monetary policy. The yen was trading close to a six-month low against the greenback yesterday, after Federal Reserve Chairman, Ben Bernanke stated that the inflation expectations need to be watched “extremely closely.â€

In economic news, the Institute for Supply Management (ISM) reported that the non-manufacturing index in the US unexpectedly fell to 57.3 in March, following 59.7 in February.

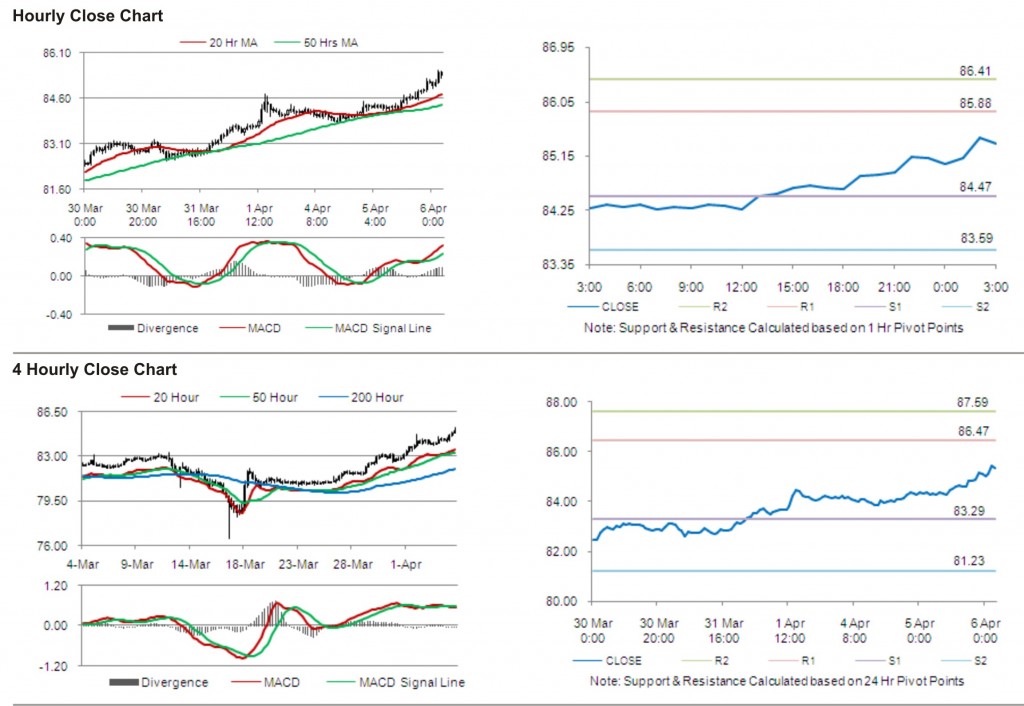

In the Asian session at 3:00GMT, the pair is trading higher from the New York close, by 0.28%, at 85.35.

The first short term resistance is at 85.88, followed by 86.41. The pair is expected to find support at 84.47 and the subsequent support level at 83.59.

Trading trends in the pair today are expected to be determined by coincident index and leading economic index data due to be released in Japan, later today.

The currency pair is trading well above its 20 Hr and 50 Hr moving averages.