For the 24 hours to 23:00 GMT, the USD declined 0.3% against the JPY and closed at 111.15 on Friday.

Over the weekend, macro data indicated that Japan’s Merchandise total trade balance narrowed more than expected to ¥481.7 billion in April, from ¥614.7 billion reported in the previous month. Markets expected the figures to decrease to ¥520.7 billion. Moreover, the nation’s exports jumped 7.5% YoY in April, less than analysts’ expectations of 8.0% gain, helped by strong demand in Asia for semiconductors, semiconductor-making equipment and steel. Exports had risen 12.0% in the prior month. On the other hand, imports rose 15.1%, more than expectations of 14.8% rise, after recording a 15.8% growth in the previous month.

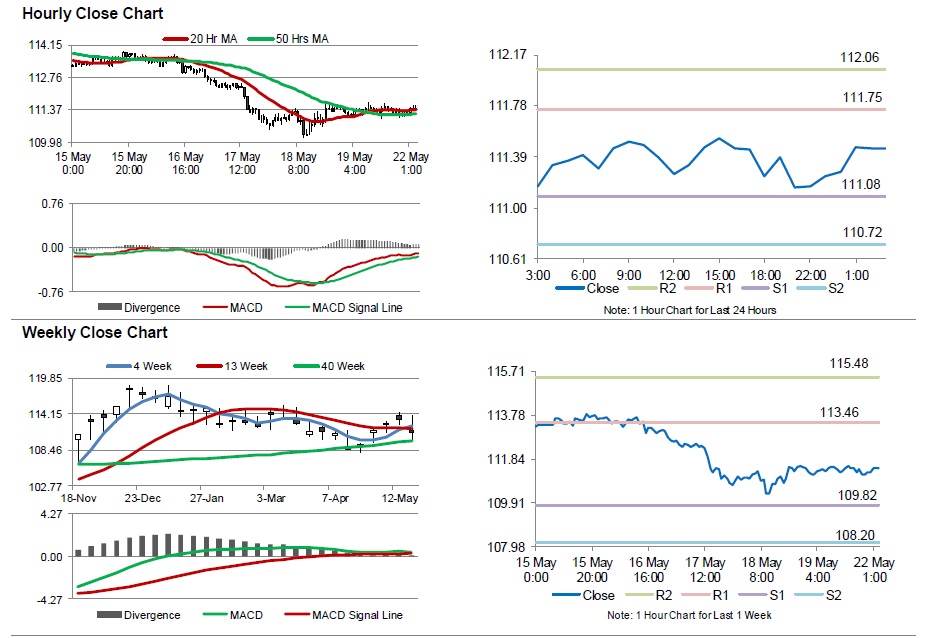

In the Asian session, at GMT0300, the pair is trading at 111.45, with the USD trading 0.27% higher against the JPY from Friday’s close.

The pair is expected to find support at 111.08, and a fall through could take it to the next support level of 110.72. The pair is expected to find its first resistance at 111.75, and a rise through could take it to the next resistance level of 112.06.

Going forward, traders will keep a close eye on preliminary reading of Japan’s Nikkei manufacturing PMI data for May, slated to release overnight, to gauge strength in the nation’s manufacturing sector.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.