For the 24 hours to 23:00 GMT, EUR rose 0.86% against the USD and closed at 1.2969, as investor sentiment was lifted after the successful bond auction in Spain and France.

France raised €9.463 billion by selling its medium and longer-term bonds in the first sale, while Spain successfully raised €6.61 billion from the sale of its bonds maturing in 2016, 2019 and 2022 at lower yields.

Optimism was further boosted after the news that Greece is nearing a deal with its private creditors.

Moreover, the European Central Bank (ECB) stated that there are signs the economy is stabilizing and the ECB’s record loans to financial institutions would help to support growth. In its monthly report, ECB stated that “while the economic outlook remains subject to high uncertainty, there are tentative signs of a stabilization in activity at low levels”.

Meanwhile in economic news, current account deficit in Euro-zone narrowed to €1.8 billion in November, from €6.6 billion in October.

In the Asian session, at GMT0400, the pair is trading at 1.2965, with the EUR trading 0.03% lower from yesterday’s close.

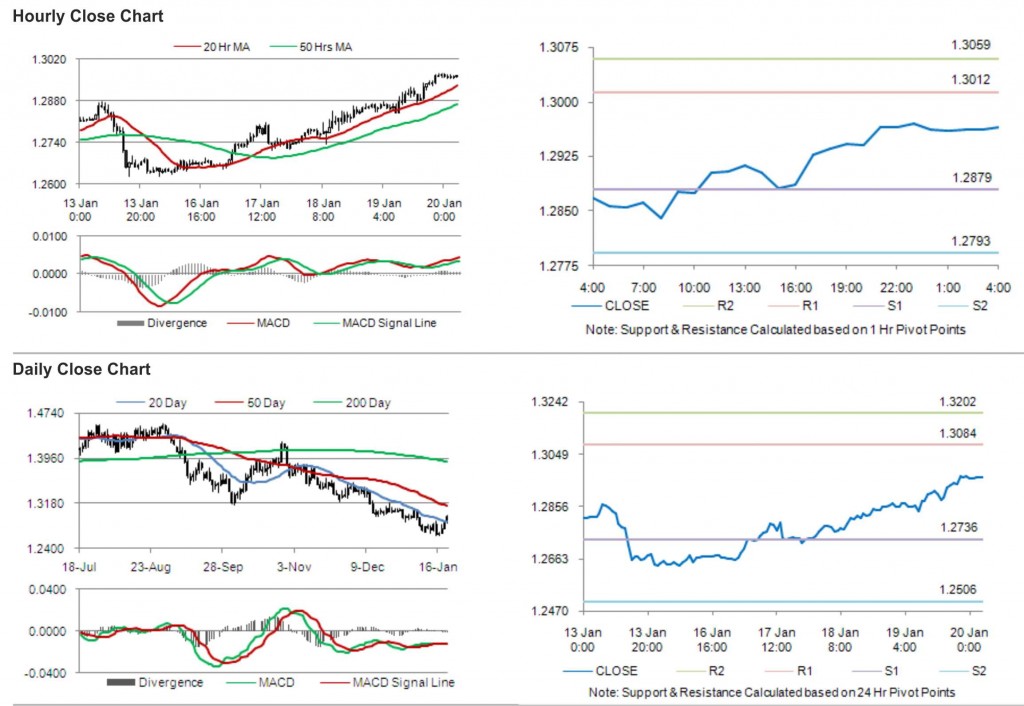

The pair is expected to find support at 1.2879, and a fall through could take it to the next support level of 1.2793. The pair is expected to find its first resistance at 1.3012, and a rise through could take it to the next resistance level of 1.3059.

Trading trends in the pair today are expected to be determined by the release of German producer price data in the day ahead.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.