For the 24 hours to 23:00 GMT, the GBP fell 0.22% against the USD and closed at 1.6944. However, data revealed that the number of mortgage approvals for house purchases in the UK rose to 67.2K in June, compared to 62.0K approvals reported in the previous month and the markets expected mortgage approvals to rise to 63.0K in June.

Separately, the Bank of England reported that net consumer credit registered a rise of £0.4 billion in the UK, in June, lesser than market expectations for an advance of £0.8 billion. In the previous month, net consumer credit had climbed by £0.7 billion. Simultaneously, net lending to individuals climbed by £2.5 billion in June, lower than market expectations for an advance of £2.6 billion, compared to £3.0 billion in the prior month. On the other hand, M4 money supply unexpectedly advanced 0.1% in June, on a monthly basis, higher than market expectations for a steady reading. It had dropped 0.1% a month ago.

Yesterday, the Bank of England (BoE) Deputy Governor, Ben Broadbent, stated that though the Pound is overvalued by 5% to 10%, but the large current account deficit did not pose any major threat to the nation’s economic growth. However, he further added that if the global economy remains sluggish, it would be harder for the British economy to achieve strong and balanced growth.

In the Asian session, at GMT0300, the pair is trading at 1.6950, with the GBP trading marginally higher from yesterday’s close.

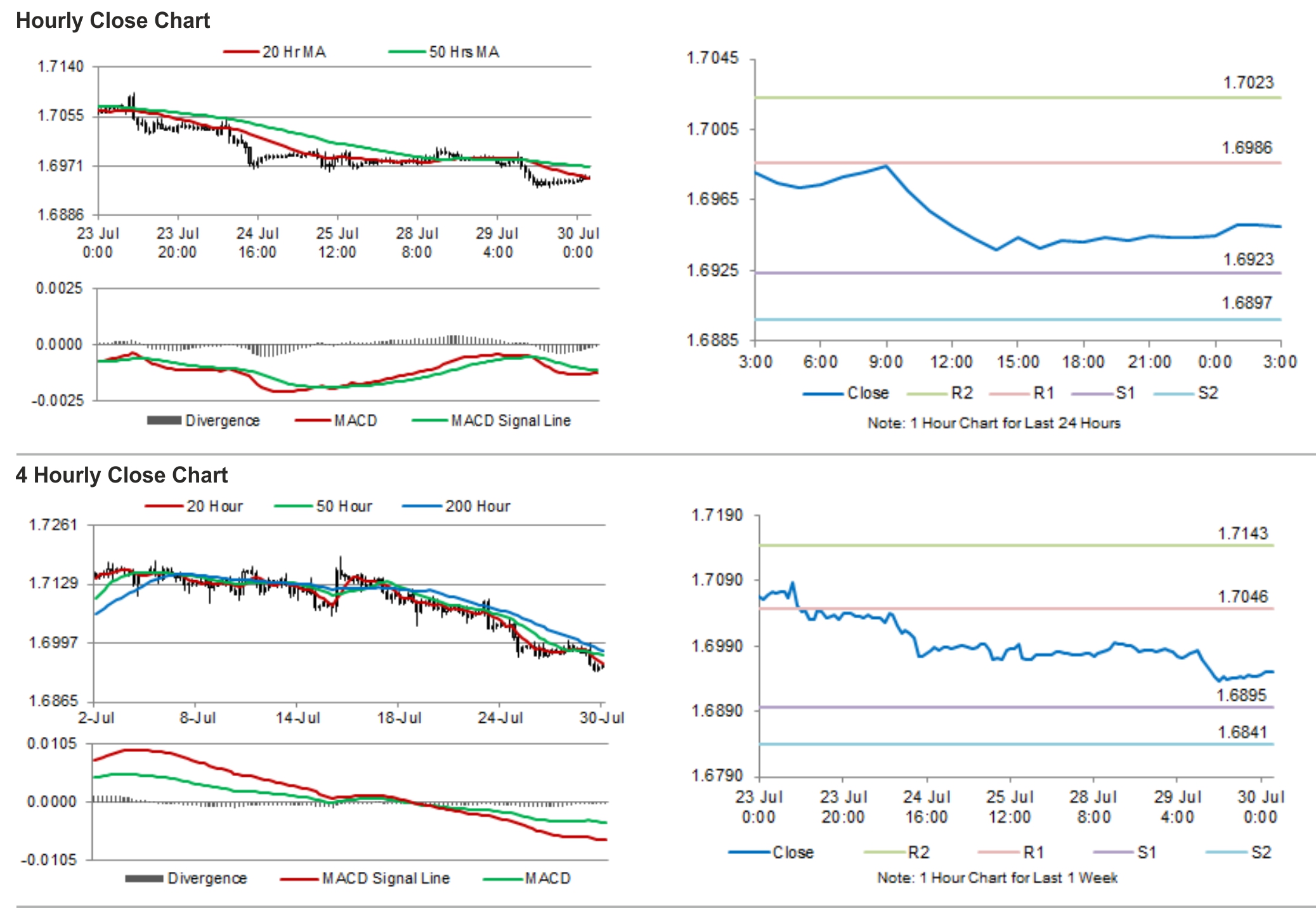

The pair is expected to find support at 1.6923, and a fall through could take it to the next support level of 1.6897. The pair is expected to find its first resistance at 1.6986, and a rise through could take it to the next resistance level of 1.7023.

Trading trends in the pair today are expected to be determined by the release of Gfk consumer confidence scheduled to be out later during the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.