For the 24 hours to 23:00 GMT, the GBP declined 0.94% against the USD and closed at 1.3100, after data indicated that UK’s economic activity deteriorated steeply in July, in the wake of last month’s EU referendum.

Data suggested that UK’s flash Markit services PMI fell more-than-expected to a level of 47.4 in July, entering into contraction territory and recording its worst reading since March 2009. The index registered a level of 52.3 in the prior month while markets expected the services PMI to ease to a level of 48.8. Also, the preliminary manufacturing PMI declined less-than-anticipated to a level of 49.1 in July, striking its lowest level since February 2013, compared to market consensus of a fall to a level of 47.5 and following a reading of 52.1 in the prior month.

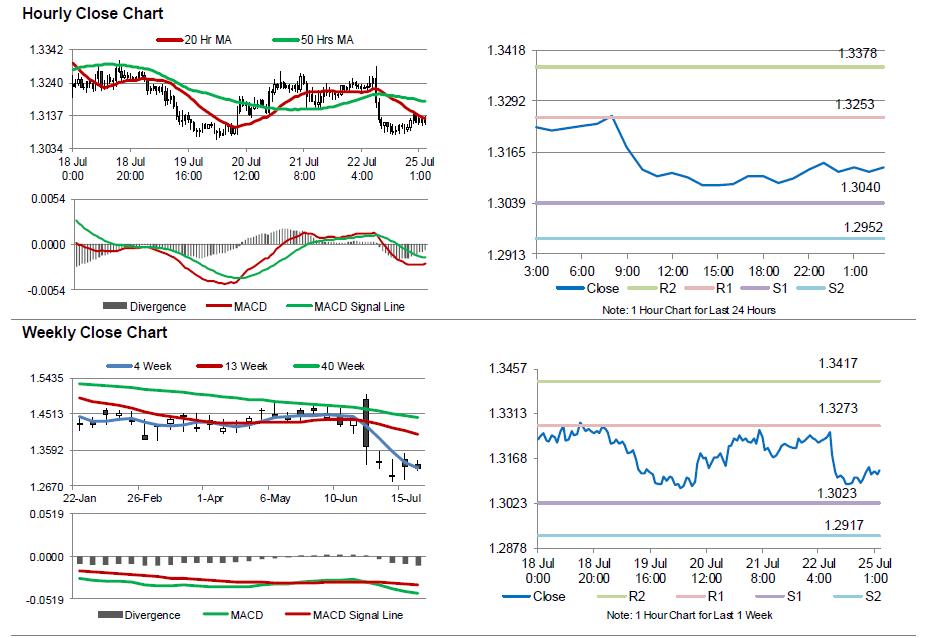

In the Asian session, at GMT0300, the pair is trading at 1.3129, with the GBP trading 0.22% higher against the USD from Friday’s close.

The pair is expected to find support at 1.3040, and a fall through could take it to the next support level of 1.2952. The pair is expected to find its first resistance at 1.3253, and a rise through could take it to the next resistance level of 1.3378.

With no major economic releases in UK today, investors would closely watch UK’s flash Q2 GDP data, slated to release on Wednesday.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.