For the 24 hours to 23:00 GMT, USD weakened 0.29% against the JPY and closed at 76.95, after the release of Federal Budget Balance data in the US.

The US federal budget balance fell unexpectedly to a seasonally adjusted -134.2 billion in August, from -129.4 billion in the last month. Additionally, the import price index fell 0.4% (M-o-M) in August, following a 0.3% increase recorded in July.

This morning, according to the local Japanese newspaper, Yomiuri, the Japanese government is considering compiling a fourth extra budget for the fiscal year to March 2012 of about 1 to 2 trillion yen ($13-26 billion) to fund additional economic steps without issuing new bonds. It further stated that the extra budget, which Prime Minister, Yoshihiko Noda’s government may start compiling as early as November, could provide funding for economic measures as concerns grow over a global economic slowdown and the euro zone debt crisis.

In the Asian session at 3:00GMT, the dollar is trading higher against yen from yesterday’s close at 23:00 GMT, by 0.10%, at 77.03.

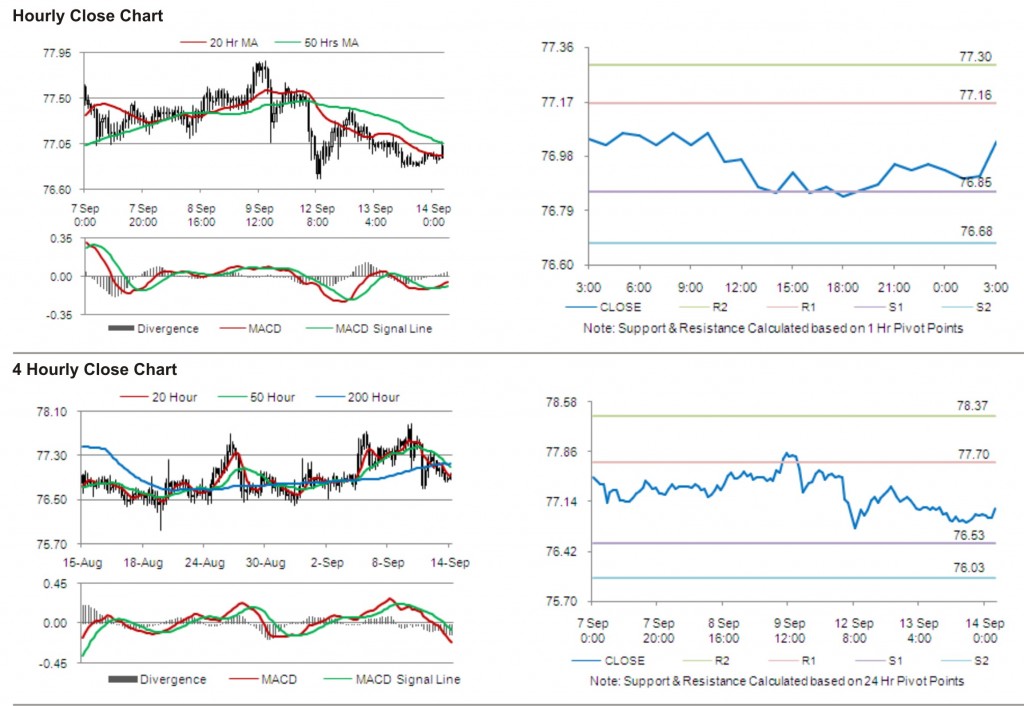

The first short term resistance is at 77.16, followed by 77.30. The pair is expected to find support at 76.85 and the subsequent support level at 76.68.

Trading trends in the pair today are expected to be determined by release of industrial production and capacity utilization data in Japan.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.