On Friday, for the 24 hours to 23:00 GMT, GBP rose 0.49% against the USD and closed at 1.6112.

The purchasing managers’ index for the manufacturing sector in the UK declined to a five month low of 57.1 in March, from a revised 60.9 in February.

In the US, Federal Reserve Bank of Philadelphia President, Charles Plosser indicated that an increase in growth or inflation could force the Federal Reserve to begin withdrawing record monetary stimulus and possibly raise its main interest rate by the end 2011.

The pair opened the Asian session at 1.6118, and is trading at 1.6123 at 3.00GMT. The pair is trading 0.07% higher from the New York session close.

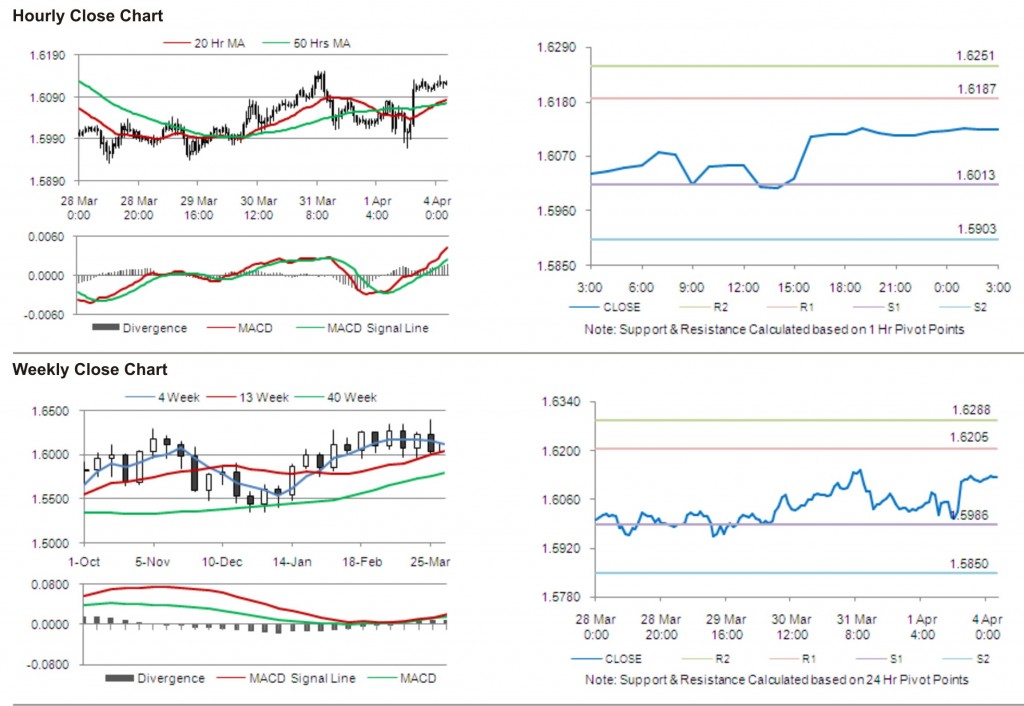

The pair has its first short term resistance at 1.6187, followed by the next resistance at 1.6251. The first support is at 1.6013, with the subsequent support at 1.5903.

Trading trends in the pair today are expected to be determined by PMI construction and BoE housing equity withdrawl data in the UK, due to be released in the day ahead.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.