For the 24 hours to 23:00 GMT, the GBP fell 0.95% against the USD and closed at 1.5512, as the UK’s inflation entered into negative territory for the first time since 1960 in April.

Data showed that the nation’s consumer inflation unexpectedly slid 0.1% YoY in April, less than market expectations for an unchanged reading. In the prior month, the consumer price index had recorded a flat reading. The inflation reading was in line with last week’s quarterly inflation report from the BoE, which had forecasted inflation to temporarily turn negative in the near term.

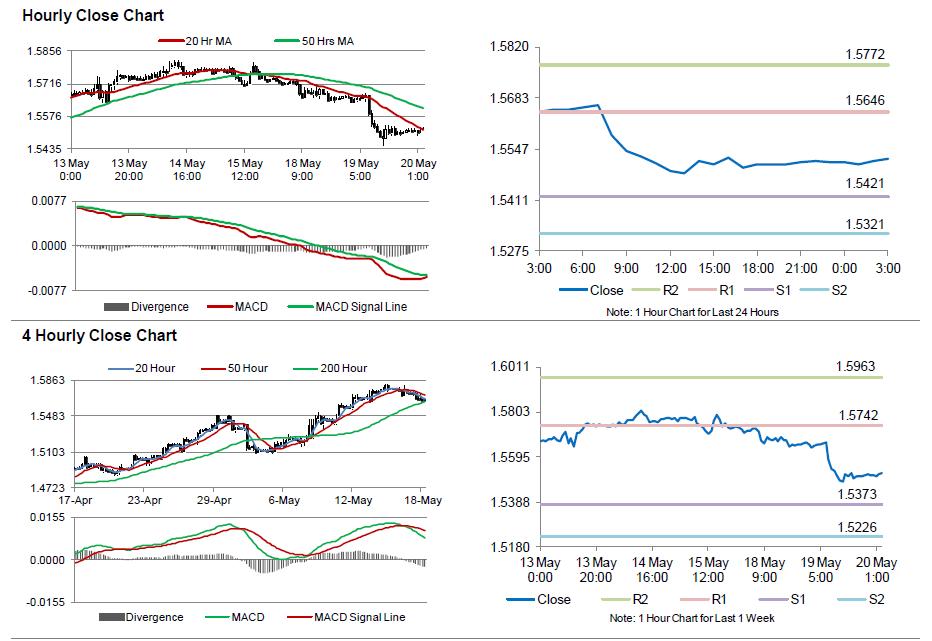

In the Asian session, at GMT0300, the pair is trading at 1.5521, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5421, and a fall through could take it to the next support level of 1.5321. The pair is expected to find its first resistance at 1.5646, and a rise through could take it to the next resistance level of 1.5772.

Trading trends in the Pound today are expected to be determined by the BoE minutes, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.