For the 24 hours to 23:00 GMT, GBP fell 0.79% against the USD and closed at 1.5901.

The British Chambers of Commerce (BCC) has warned that the UK economic recovery would remain fragile until the government places a greater emphasis on private sector growth.

In the morning news, the British Retail Consortium (BRC) reported that retail sales values were 0.6% (YoY) lower on a like-for-like basis in June, an improvement on the 2.1% like-for-like drop in May. Separately, the Royal Institution of Chartered Surveyors’ seasonally adjusted house price balance edged up to -27 in June, from -28 in May.

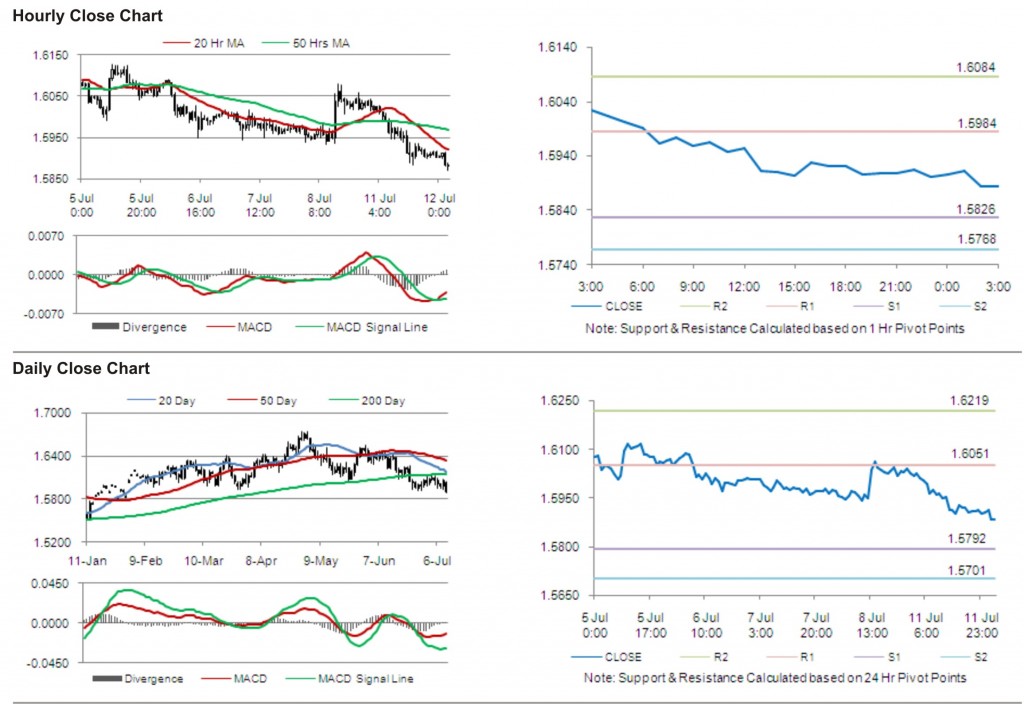

The pair opened the Asian session at 1.5901, and is trading at 1.5883 at 3.00GMT. The pair is trading 0.11% lower from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.5984, followed by the next resistance at 1.6084. The first support is at 1.5826, with the subsequent support at 1.5768.

Trading trends in the pair today are expected to be determined by release of consumer price index in the UK.

The pair is trading below its 20 Hr and 50 Hr moving averages.