For the 24 hours to 23:00 GMT, EUR declined 0.30% against the USD and closed at 1.4324, as weak European economic data and a jump in Italy’s borrowing costs heightened concerns over the Euro zone debt crisis. Meanwhile, the ongoing threat of a US debt default kept a check on greenback’s gain.

In the economic news, the economic sentiment index in the Euro-zone declined to a reading of 103.2 in July, following a reading of 105.4 recorded in the previous month. Industrial confidence declined to 1.1 in July, from 3.5 in June. The consumer confidence decreased to -11.2 in July, following a -9.7 drop in June.

Additionally, in Germany, the unemployment change dropped by 11000 in July, following 8000 decrease in June. Meanwhile, the unemployment rate remained steady at a record low of 7.0% in July.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4353, 0.20% higher from the levels yesterday at 23:00GMT.

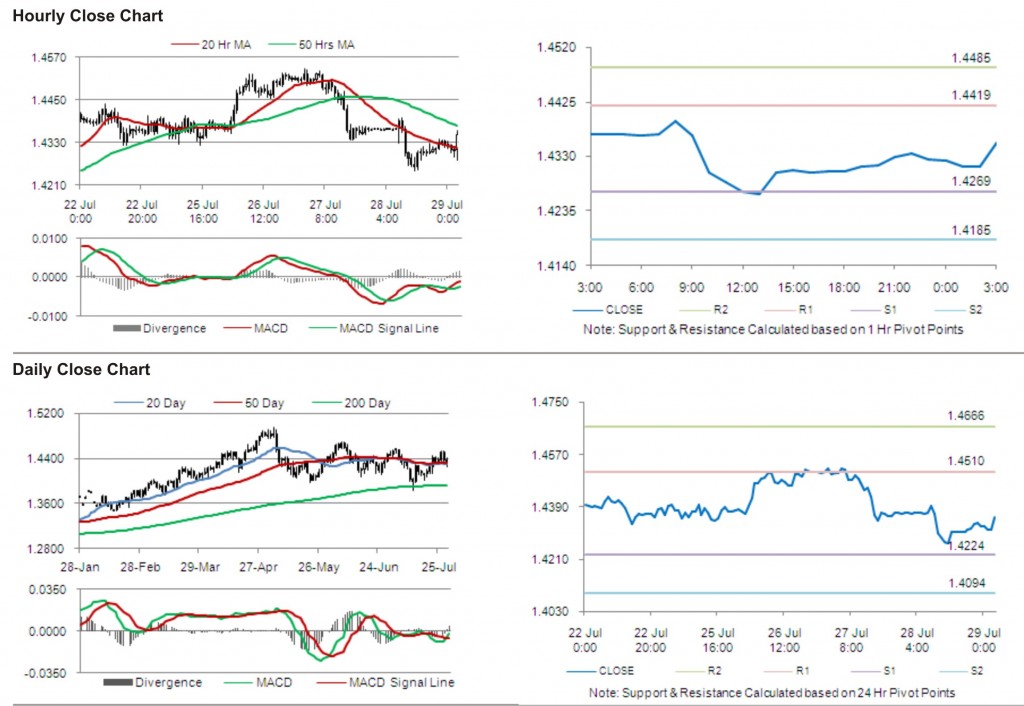

The pair has its first short term resistance at 1.4419, followed by the next resistance at 1.4485. The first support is at 1.4269, with the subsequent support at 1.4185.

Trading trends in the pair today are expected to be determined by release of consumer price index in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.