Oil prices declined 1.78% against the USD for the 24 hour period ending 23:00GMT, closing at 95.90, after a dismal German bond auction and weaker-than-expected Euro-zone manufacturing data, added to concerns over an already bleak global outlook.

Yesterday the Energy Information Administration (EIA) reported that crude oil inventories retreated by 6.2 million barrels in the week ended November 18. Gasoline inventories climbed 4.5 million barrels while supplies of distillates, including heating oil, dropped 800,000 barrels.

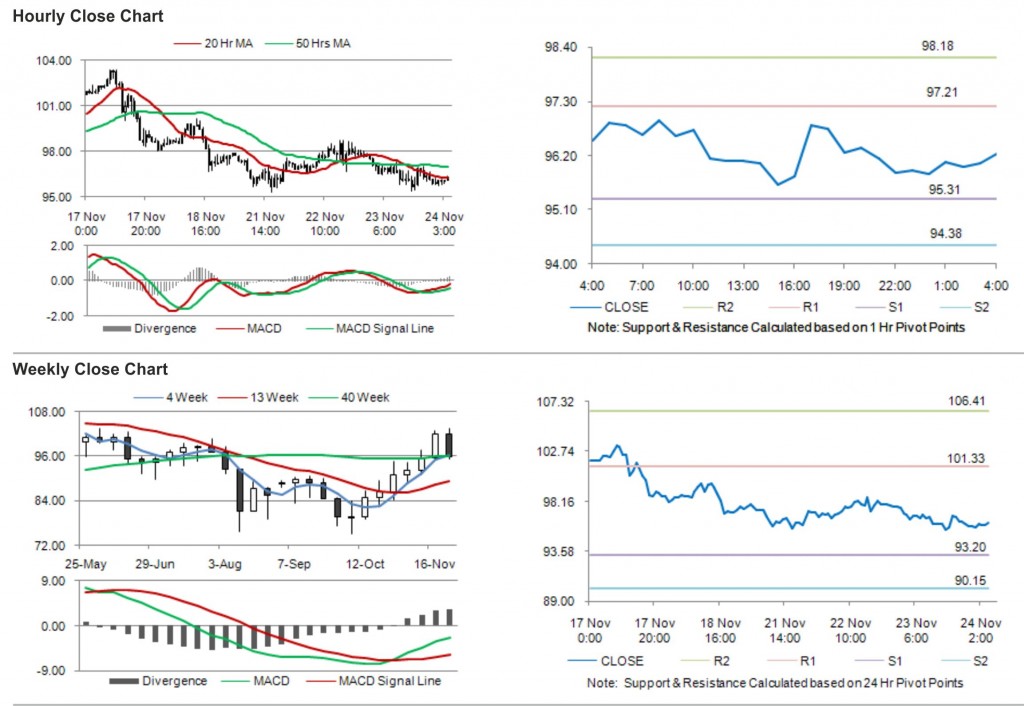

In the Asian session, at GMT0400, Crude Oil is trading at 96.24, 0.35% higher from yesterday’s close.

Crude oil is expected to find support at 95.31, and a fall through could take it to the next support level of 94.38. Crude oil is expected to find its first resistance at 97.21, and a rise through could take it to the next resistance level of 98.18.

The pair is showing convergence with its 20 Hr moving average and is moving below its 50 Hr moving average.