For the 24 hours to 23:00 GMT, EUR declined 1.27% against the USD and closed at 1.3342, as a weak German bond auction disappointed investors.

The Euro also came under pressure, following reports that Belgium and France were in fresh talks over the rescue deal for Dexia, stirring worries over the potential for an increased fiscal burden on France, which could have implications for France’s AAA credit rating.

In the Euro-zone, manufacturing PMI declined to 46.4 in November, compared to 47.1 in October. The services PMI rose unexpectedly to 47.8 in November, from 46.4 in October.

Additionally, industrial new orders in the Euro-zone, on a seasonally adjusted basis, declined 6.4% (MoM) in September, from a 1.4% gain in August.

In Germany, the manufacturing Purchasing Managers’ Index (PMI) dropped to 47.9 in November, marking a 28-month low, from 49.1 in October. Also, the services PMI climbed unexpectedly to 51.4 in November, recording a 4-month high, from 50.6 in the previous month.

In France, the manufacturing PMI retreated to 47.6 in November, from 48.5 in October. Meanwhile, the services PMI rose to 49.3 in November, from 44.6 in October.

In the Asian session, at GMT0400, the pair is trading at 1.3379, with the EUR trading 0.27% higher from yesterday’s close.

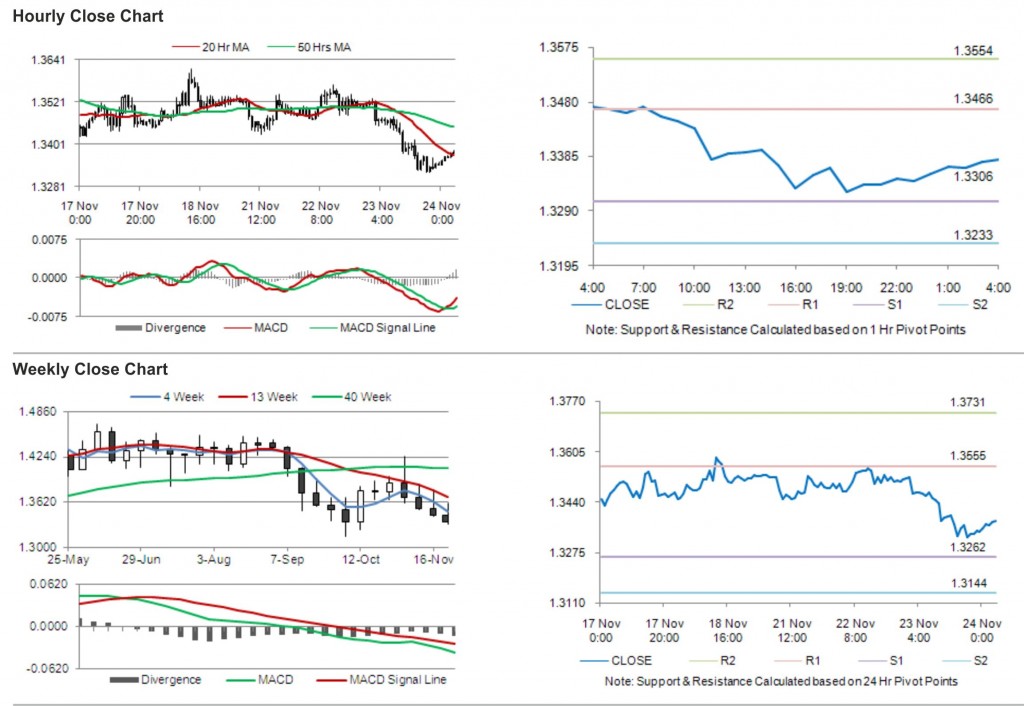

The pair is expected to find support at 1.3306, and a fall through could take it to the next support level of 1.3233. The pair is expected to find its first resistance at 1.3466, and a rise through could take it to the next resistance level of 1.3554.

Trading trends in the pair today are expected to be determined by Gross Domestic Product (GDP) and IFO economic expectations data in Germany.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.