Crude Oil prices declined 1.70% against the USD for the 24 hour period ending 23:00GMT, closing at 98.69, as lingering concerns on rising US crude stockpiles and a stronger US Dollar weighed on the demand prospect of the commodity. However, the losses in the prices of crude oil were limited to some extent after a better-than-expected Philadelphia Fed’s manufacturing index eased some concerns on the demand-outlook of the commodity.

In the Asian session, at GMT0400, Crude Oil is trading at 98.46, 0.23% lower from yesterday’s close.

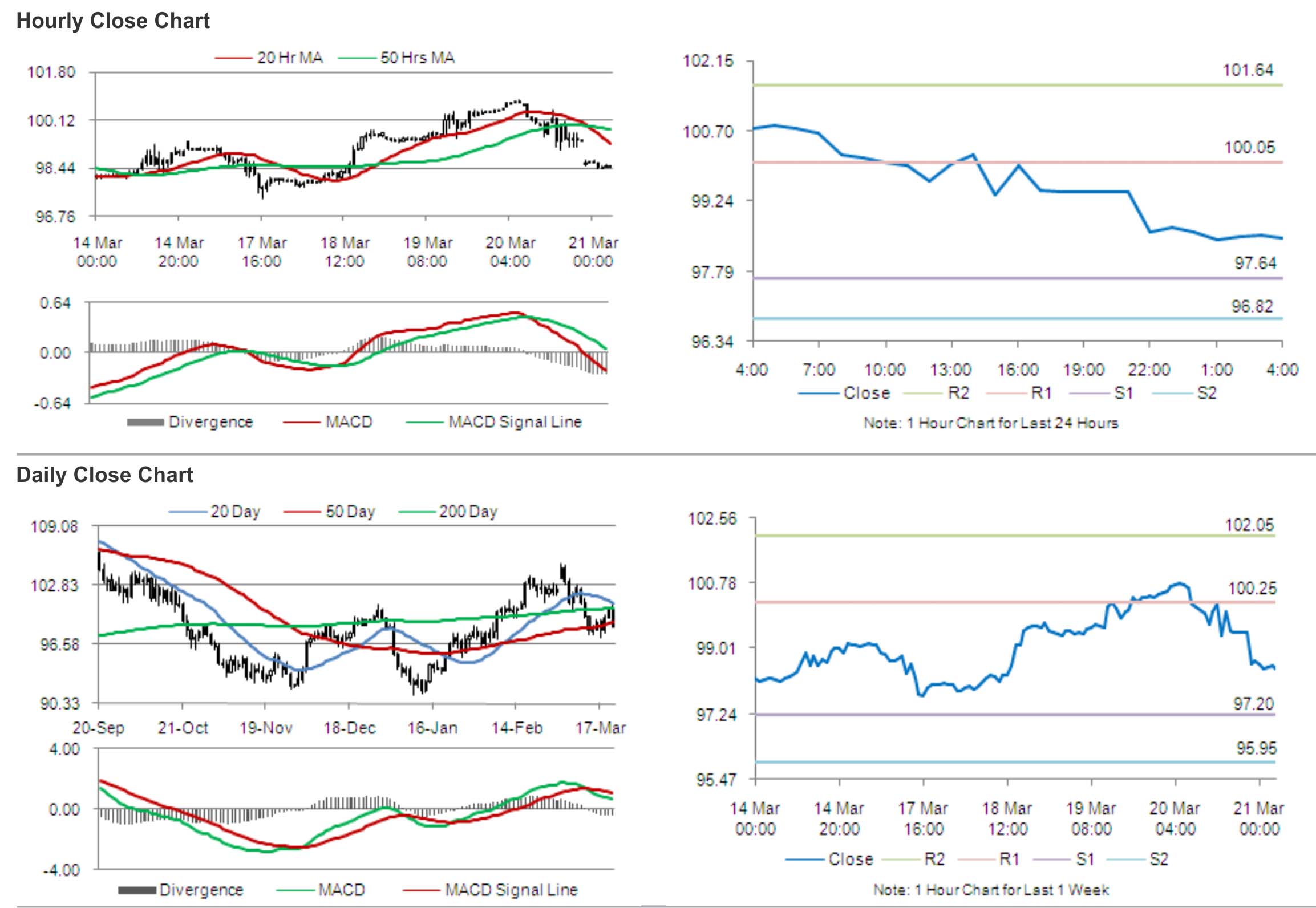

Crude oil is expected to find support at 97.64, and a fall through could take it to the next support level of 96.82. Crude oil is expected to find its first resistance at 100.05, and a rise through could take it to the next resistance level of 101.64.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.