On Friday, EUR rose 0.12% against the USD and closed at 1.3795, as risk-appetite among traders rose after the preliminary reading of the Euro-zone’s consumer confidence index improved to a level of -9.3 in March, the highest reading level since 2007, compared to previous month’s figure of -12.7. Another official report revealed that, on a seasonally adjusted basis, Euro-zone’s current account surplus expanded to €25.3 billion in January, from a surplus of €20.0 billion, registered in the preceding month.

During the weekend, an ECB Governing Council member, Erkki Liikanen stated that ECB can still opt for an interest rate cut to support the region’s fragile recovery. Separately, the ECB Deputy President, Vitor Constancio stated that the ECB would no longer follow the threshold-based rate guidance and added that the central bank would opt for other easing policies if needed, such as rate cuts, quantitative easing, negative deposit facility rates and targeted liquidity provision operations. Furthermore, he hinted towards the possibility of a slower growth in the region’s economy, citing downside risks to the recovery of the Euro-zone economy,

In the US, speculations for a possible rating downgrade of the world’s largest economy eased after the Fitch Ratings, citing the suspension on the US Federal debt limit, affirmed its “AAA” sovereign rating on the US with a “Stable” outlook.

Meanwhile, the Minneapolis Fed President, Narayana Kocherlakota, outlined the impact of a possible financial crisis on the nation’s unemployment level and suggested that raising benchmark interest rates to combat such threats could prove non-beneficial. Furthermore, he indicated that the Fed’s intentions on forward guidance remain the same as set forth in its recent statements despite the recent change in some its guideposts on the interest rate outlook. Separately, the St Louis Fed President, James Bullard stated that the Fed Chief, Janet Yellen’s comments, made earlier during the week, that she sees a considerable period of six months or so between the end of the central bank’s stimulus measures and a hike in interest rate, was in line with the private surveys on when the central bank might start tightening policy. Meanwhile, in his speech at the London School of Economics, Richard Fisher, the President of the Dallas Fed, opined that the Fed’s new guidance on interest rate could be “sloppier” than previous insight even as it is designed to smooth the transition from a near-zero interest rates to a return to higher interest rates.

In the Asian session, at GMT0400, the pair is trading at 1.3803, with the EUR trading 0.06% higher from Friday’s close.

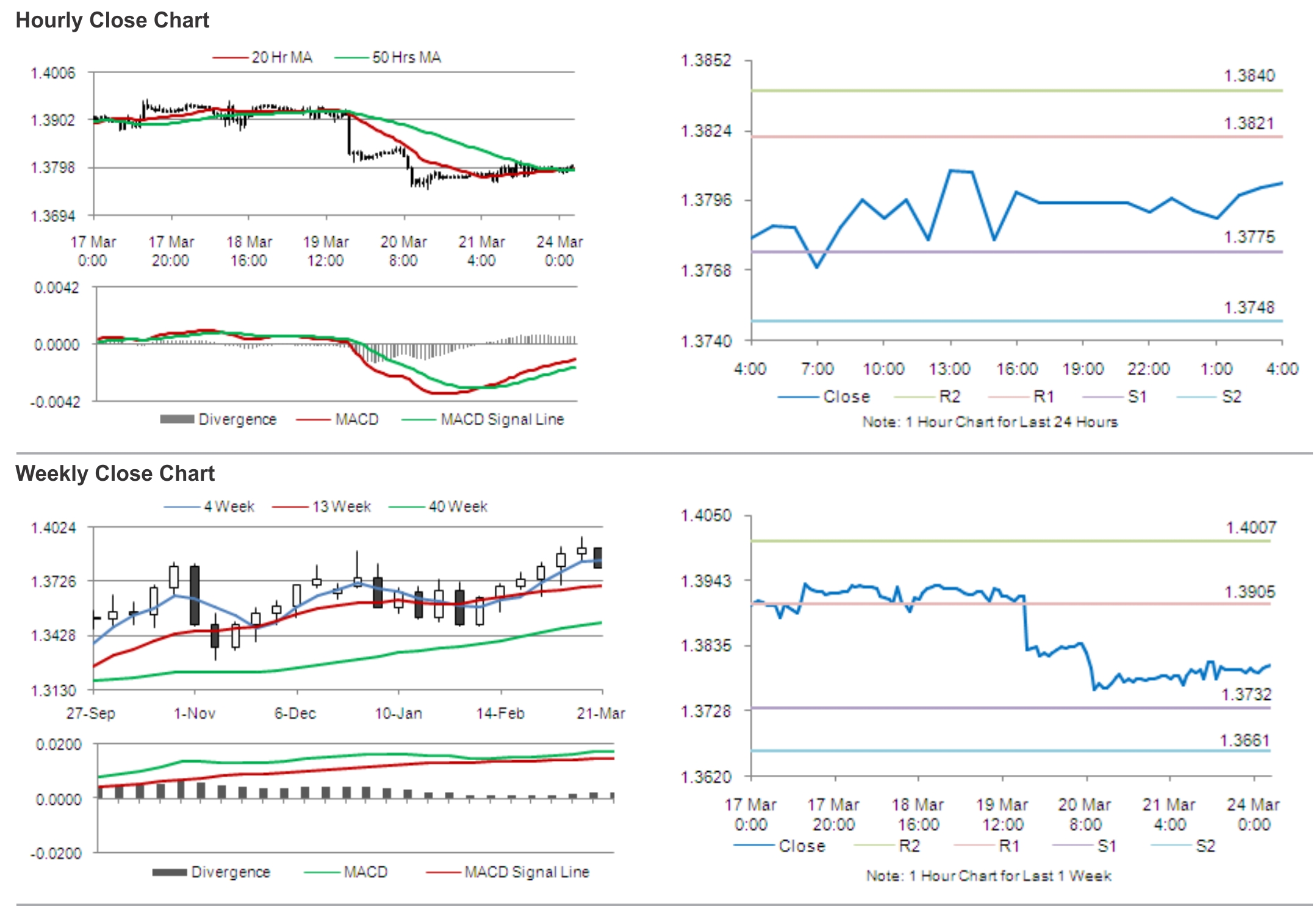

The pair is expected to find support at 1.3775, and a fall through could take it to the next support level of 1.3748. The pair is expected to find its first resistance at 1.3821, and a rise through could take it to the next resistance level of 1.3840.

Traders await Euro-zone’s, Germany’s and France’s Markit manufacturing and service PMI data for March and the Bundesbank President, Jens Weidmann’s speech, due later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.