For the 24 hours to 23:00 GMT, Crude Oil declined 2.45% against the USD and closed at USD52.87 per barrel yesterday, amid rising concerns about global crude oil demand, as the death toll from China’s coronavirus rapidly increases and as businesses were forced to shut down. Further, reports indicated that there were preliminary discussions among OPEC+ for an extension of the current oil supply cuts beyond March 2020, if the spread of coronavirus impacts crude oil demand.

In the Asian session, at GMT0400, the pair is trading at 52.87, with oil holding steady against the USD from yesterday’s close.

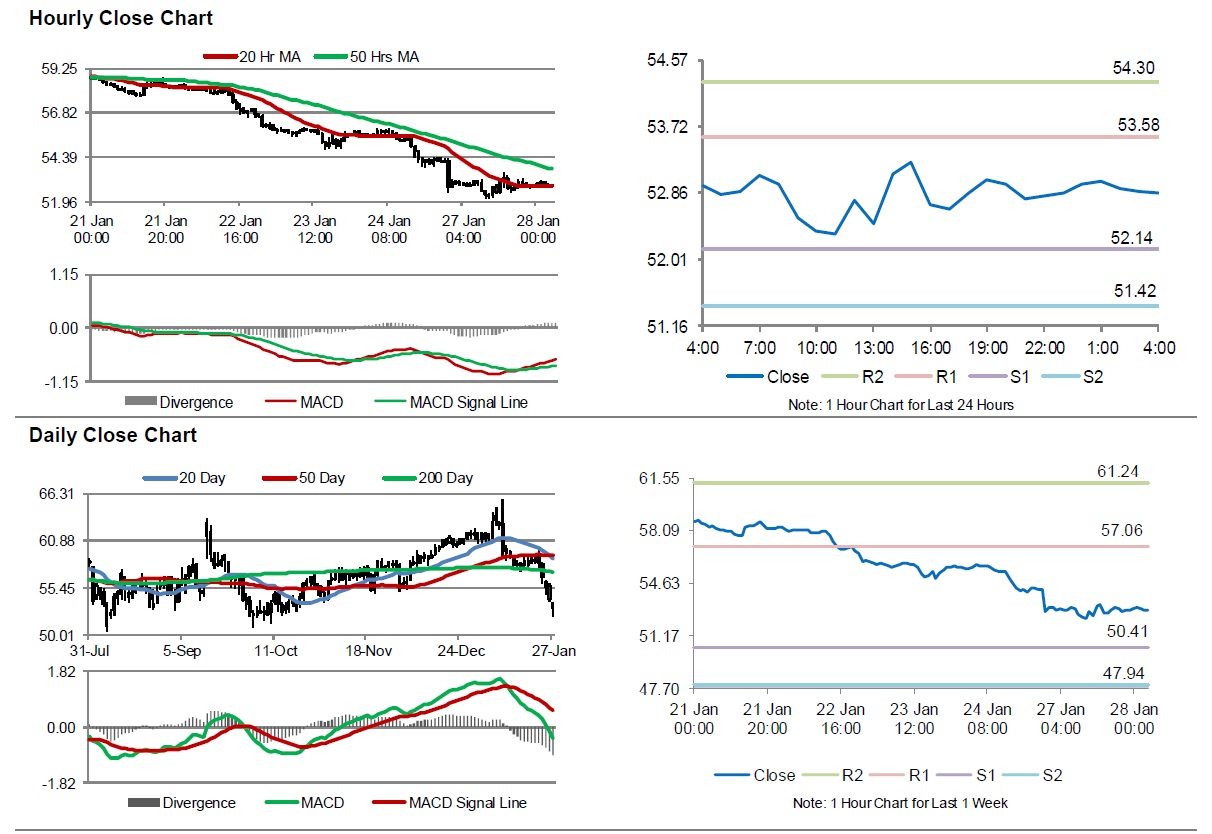

The pair is expected to find support at 52.1433, and a fall through could take it to the next support level of 51.4167. The pair is expected to find its first resistance at 53.5833, and a rise through could take it to the next resistance level of 54.2967.

Crude oil is trading between its 20 Hr and 50 Hr moving averages.