For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.1000 yesterday. In the US, core capital goods orders posted the biggest drop in eight months in December, suggesting business investment continued to contract in the fourth quarter and was a drag on economic growth. Meanwhile, durable goods orders rebounded in December, following a surge in demand for military aircraft. Additionally, in January, the Richmond Fed manufacturing index in the US registered a rise to 20.00, its highest since September 2018, as a rebound in sales and orders offered signs of stabilization. In the prior month, the Richmond Fed manufacturing index had recorded a reading of -5.00.

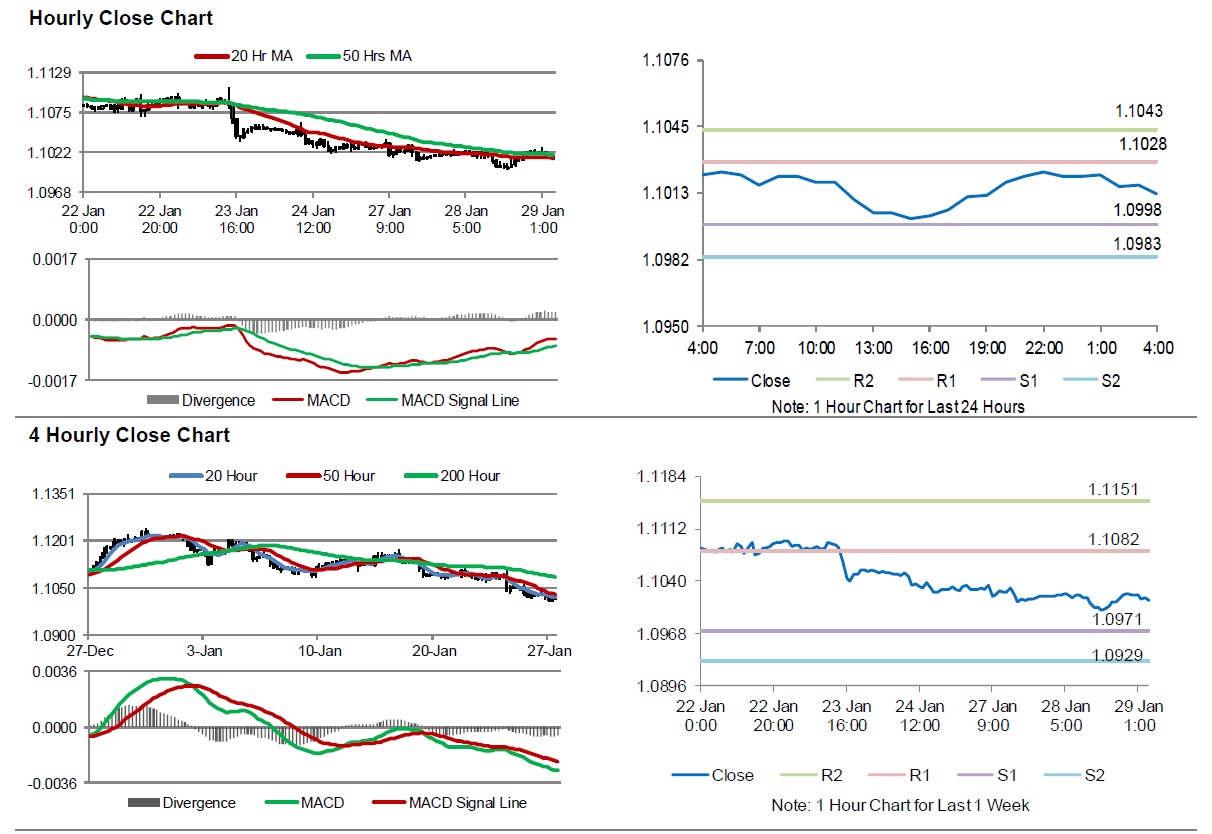

In the Asian session, at GMT0400, the pair is trading at 1.1013, with the EUR trading 0.07% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0998, and a fall through could take it to the next support level of 1.0983. The pair is expected to find its first resistance at 1.1028, and a rise through could take it to the next resistance level of 1.1043.

Looking ahead, traders would keep a close watch on the US Federal Reserve’s interest rate decision, US goods trade balance and pending home sales for December, along with the Euro-zone’s M3 money supply for December.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.