Crude Oil prices advanced 1.55% against the USD for the 24-hour period ending 23:00GMT, closing at 49.20. However, gains in oil prices were capped after data showed that China’s manufacturing sector activity stalled in June, thus raising demand concerns from the world’s second largest consumer of oil.

Separately, Baker Hughes reported that the total US oil rig count rose by 11 to a level of 341 in the week ended July 01, its biggest increase since December 2015.

In the Asian session, at GMT0300, the pair is trading at 48.96, with the oil trading 0.49% lower from Friday’s close.

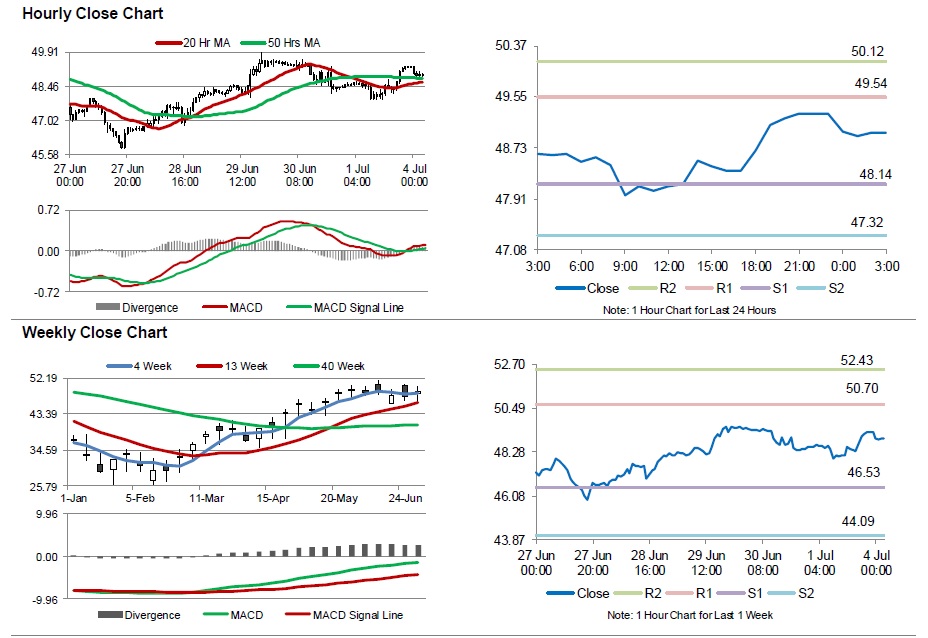

The pair is expected to find support at 48.14, and a fall through could take it to the next support level of 47.32. The pair is expected to find its first resistance at 49.54, and a rise through could take it to the next resistance level of 50.12.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.