For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.1145, after the Euro-zone’s producer price index (PPI) rebounded above expectations and gained 0.6% MoM in May, recording its fastest increase in over a year, helped by an increase in energy prices. PPI had dropped by 0.3% in the previous month. On the other hand, the region’s Sentix investor confidence index fell to a level of 1.7 in July, its lowest level since January 2015, following the UK’s surprise decision to leave the European Union. The index had registered a reading of 9.9 in the previous month.

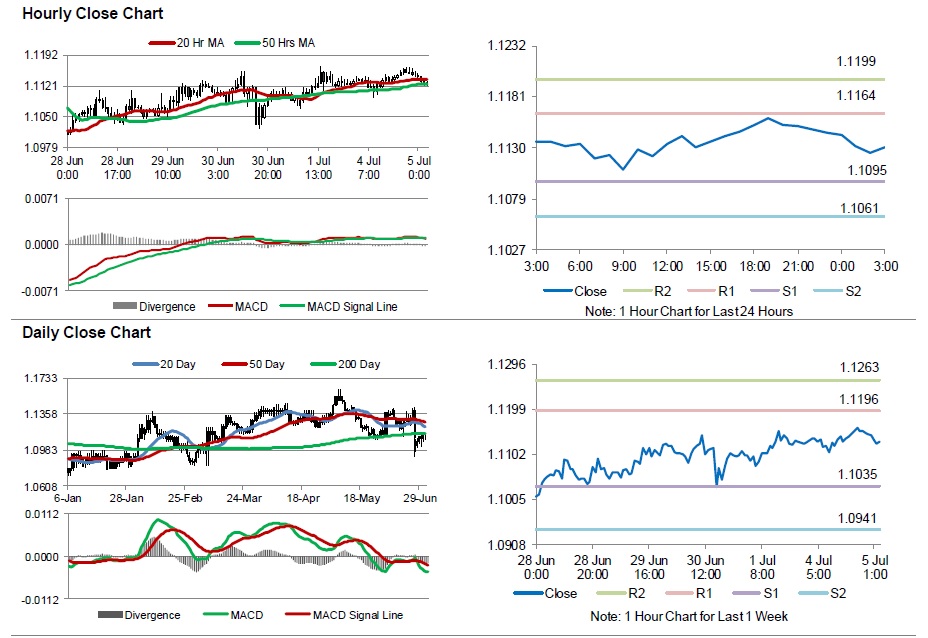

In the Asian session, at GMT0300, the pair is trading at 1.1130, with the EUR trading 0.13% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1095, and a fall through could take it to the next support level of 1.1061. The pair is expected to find its first resistance at 1.1164, and a rise through could take it to the next resistance level of 1.1199.

Going ahead, investors will look forward to the Markit services PMI data for June across the Euro-zone, scheduled to release in a few hours. Additionally, the US factory orders and the IBD/TIPP economic optimism index, due later today, will also attract market attention.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.