For the 24 hours to 23:00 GMT, Crude Oil rose 0.58% against the USD and closed at USD57.09 per barrel, lifted by ongoing supply concerns following the shutdown of the Forties Pipeline system in the North Sea.

Meanwhile, the International Energy Agency (IEA), indicated that global oil supplies rose by 170,000 barrels per day (bpd) in November to 97.8 million bpd.

Moreover, the agency forecasted a rise of 200,000 bpd in the global oil market in the first half of next year and added that US crude output next year would increase by 870,000 bpd, up from its November forecast of 790,000 bpd.

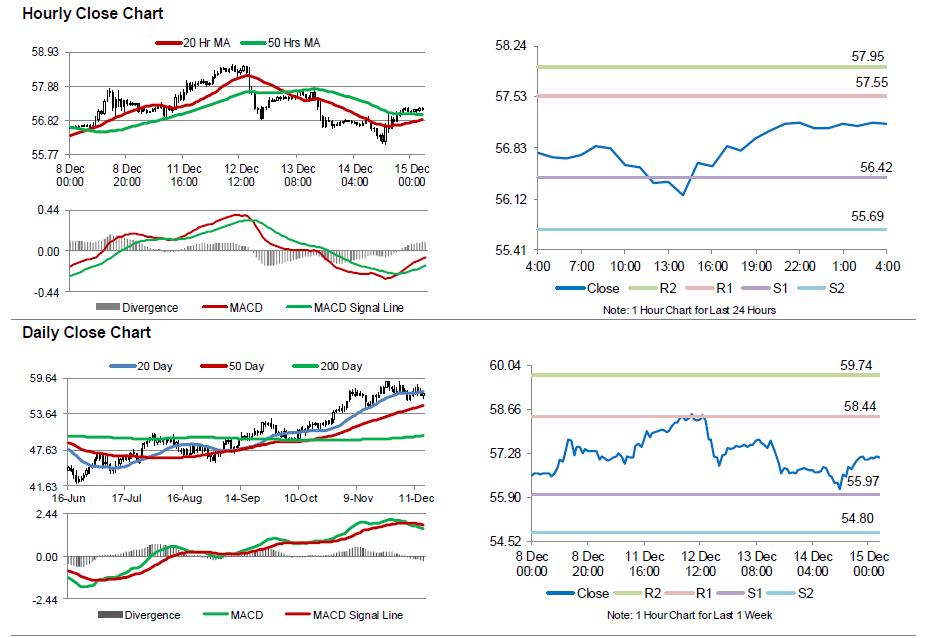

In the Asian session, at GMT0400, the pair is trading at 57.15, with oil trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 56.42, and a fall through could take it to the next support level of 55.69. The pair is expected to find its first resistance at 57.55, and a rise through could take it to the next resistance level of 57.95.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.