For the 24 hours to 23:00 GMT, the EUR declined 0.09% against the USD and closed at 1.1756 on Friday, after the Euro-zone’s seasonally adjusted trade surplus narrowed to a three-month low of €19.0 billion in October, amid a drop in exports and a rise in imports. In the previous month, the region had posted a revised trade surplus of €24.5 billion, while markets had expected for a fall to €24.3 billion.

The greenback gained ground against a basket of major currencies on Friday, amid growing expectations that US lawmakers will pass a long-awaited tax bill before the year-end.

On the macro front, industrial production in the US advanced 0.2% on a monthly basis in November, undershooting market consensus for an increase of 0.3%, as gains in the mining sector were offset by a fall in utilities output. Industrial production had registered a revised rise of 1.2% in the prior month. Moreover, the nation’s manufacturing production grew less-than-expected by 0.2% on a monthly basis in November, against market anticipations for an advance of 0.3%. Manufacturing production had registered a revised rise of 1.4% in the previous month.

Other data indicated that the New York Empire State manufacturing index eased more-than-anticipated to a level of 18.0 in December. In the prior month, the index had registered a level of 19.4, while markets had expected for a fall to a level of 18.7.

In the Asian session, at GMT0400, the pair is trading at 1.1763, with the EUR trading 0.06% higher against the USD from Friday’s close.

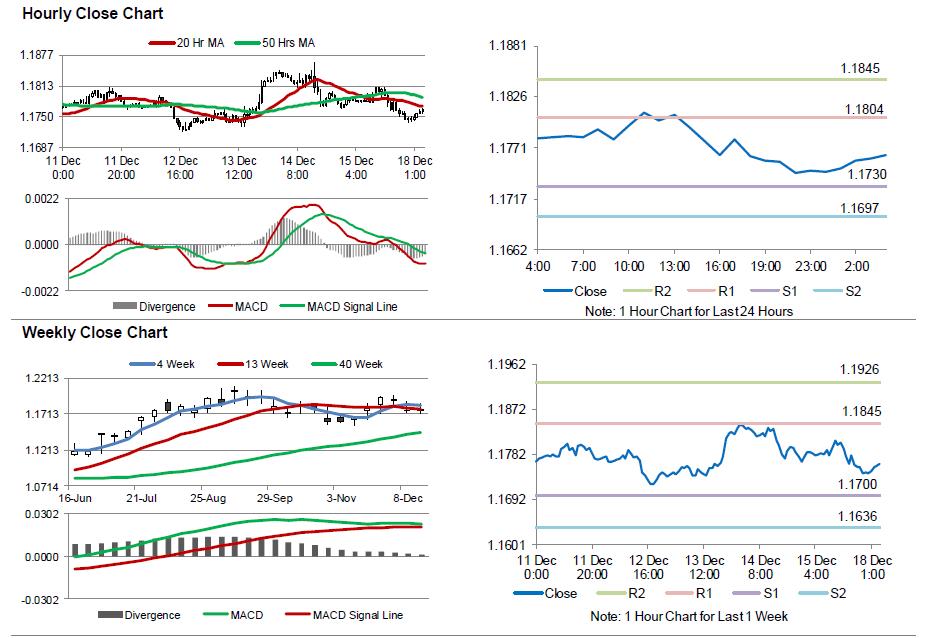

The pair is expected to find support at 1.1730, and a fall through could take it to the next support level of 1.1697. The pair is expected to find its first resistance at 1.1804, and a rise through could take it to the next resistance level of 1.1845.

Going ahead, investors would eye the Euro-zone’s final inflation numbers for November, slated to release in a few hours. Moreover, the US NAHB housing market index for December, due to release later in the day, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.