For the 24 hours to 23:00 GMT, Crude Oil declined 3.14% against the USD and closed at USD51.15 per barrel on Friday, as weak economic data from China reigned concerns of lower fuel demand from the country. Meanwhile, fresh figures from Baker Hughes disclosed that the number of active oil rigs dropped by 4 to 873 in the week ended 14 December.

In the Asian session, at GMT0400, the pair is trading at 51.32, with oil trading 0.33% higher against the USD from Friday’s close. However, oil prices continue to remain under pressure amid weaker growth in major economies and concerns about oversupply.

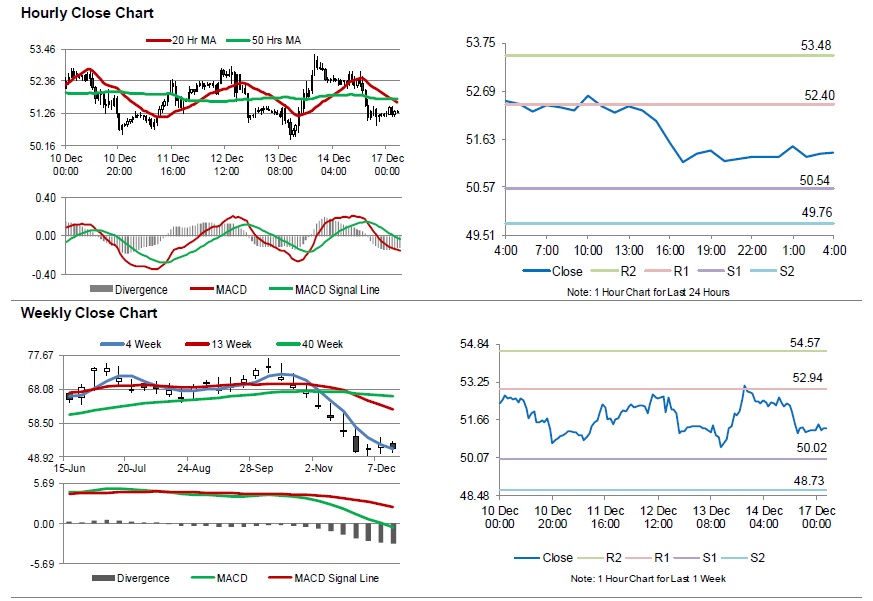

The pair is expected to find support at 50.54, and a fall through could take it to the next support level of 49.76. The pair is expected to find its first resistance at 52.40, and a rise through could take it to the next resistance level of 53.48.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.