For the 24 hours to 23:00 GMT, the EUR rose 0.34% against the USD and closed at 1.1350.

On the macro front, the Euro-zone’s final consumer price index (CPI) climbed 1.9% on an annual basis in November, less than market expectations for a rise of 2.0%. In the previous month, the CPI had registered a climb of 2.2%, while preliminary figures had also indicated a similar rise. Meanwhile, the region’s seasonally adjusted trade surplus unexpectedly narrowed for the second consecutive month to €12.5 billion in October, compared to market consensus for a surplus of €14.0 billion. The nation had posted a surplus of €13.0 billion in the prior month.

In the US, data showed that the NY Empire State manufacturing index plummeted to a 19-month low level of 10.9 in December, more than market expectations for a fall to a level of 20.0. The index had recorded a level of 23.3 in the preceding month. Also, the nation’s NAHB housing market index unexpectedly slid to a level of 56.0 in December, hitting its lowest level in 3-years and following a reading of 60.0 in the previous month. Market participants had envisaged the index to register a steady reading.

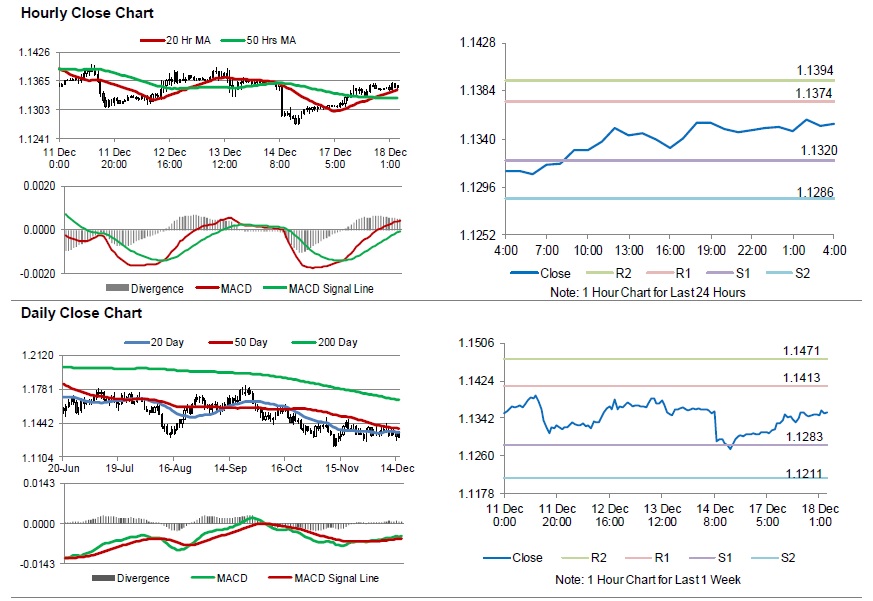

In the Asian session, at GMT0400, the pair is trading at 1.1354, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1320, and a fall through could take it to the next support level of 1.1286. The pair is expected to find its first resistance at 1.1374, and a rise through could take it to the next resistance level of 1.1394.

Moving ahead, traders would closely monitor Germany’s IFO survey indices for December, set to release in a few hours. Later in the day, the US housing starts and building permits, both for November, will garner significant amount of investor’s attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.