For the 24 hours to 23:00 GMT, Crude Oil declined 1.04% against the USD and closed at USD62.90 per barrel on Friday, amid concerns over America’s plans to issue waivers on Iranian oil sanctions and growing global crude production. Meanwhile, fresh figures from Baker Hughes disclosed that the number of active oil rigs fell by 1 to 874, declining for the first time in four weeks in the week ended 02 November.

In the Asian session, at GMT0400, the pair is trading at 62.71, with oil trading 0.30% lower against the USD from Friday’s close, as US granted Iran sanction waivers to 8 importers.

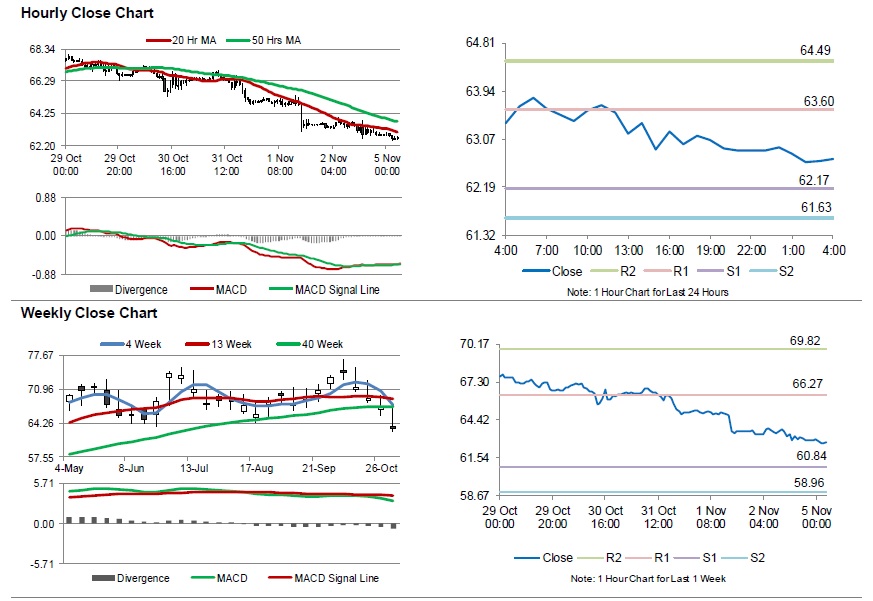

The pair is expected to find support at 62.17, and a fall through could take it to the next support level of 61.63. The pair is expected to find its first resistance at 63.60, and a rise through could take it to the next resistance level of 64.49.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.