For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.1411.

On the macro front, the Euro-zone’s Sentix investor confidence index eased for the third consecutive month to a 24-month low level of 8.8 in November, compared to a level of 11.4 in the previous month. Market participants had expected the index to drop to a level of 9.8.

In the US, data showed that the US final Markit services PMI climbed to a level of 54.8 in October, compared to a reading of 53.5 in the prior month. Market had envisaged the PMI to advance to a level of 54.6, while preliminary figures had recorded a rise to 54.7.

In the Asian session, at GMT0400, the pair is trading at 1.1405, with the EUR trading 0.05% lower against the USD from yesterday’s close.

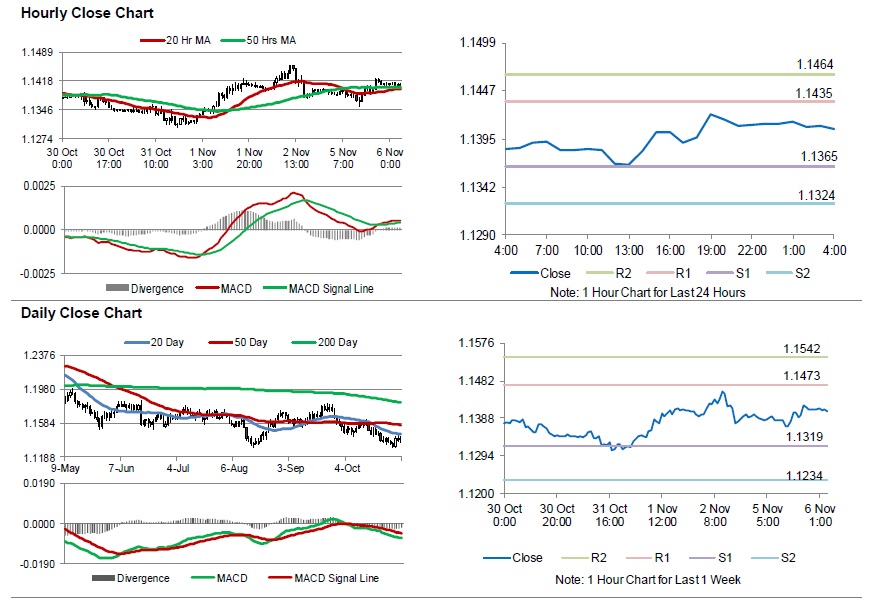

The pair is expected to find support at 1.1365, and a fall through could take it to the next support level of 1.1324. The pair is expected to find its first resistance at 1.1435, and a rise through could take it to the next resistance level of 1.1464.

Going ahead, traders would closely monitor the Markit services PMI for October, due to release across the euro bloc along with Euro-zone’s producer price index and Germany’s factory orders, both for September, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.