Crude Oil prices declined 0.92% against the USD for the 24 hour period ending 23:00GMT, closing at 99.76, as a soft first-quarter US GDP data fuelled concerns on the demand prospects of the commodity in the nation while a weekly report from the Energy Information Administration (EIA), reporting a 1.7 million barrels rise in the US crude stockpiles, eased tensions on the supply-outlook of the commodity. Oversupply concerns were also fuelled after media reports from Libya revealed that the nation’s Zueitina oil port, which was closed for nearly 10 months due to protests, would load its first tanker of crude oil on May 1-3.

In the Asian session, at GMT0300, Crude Oil is trading at 99.68, 0.08% lower from yesterday’s close.

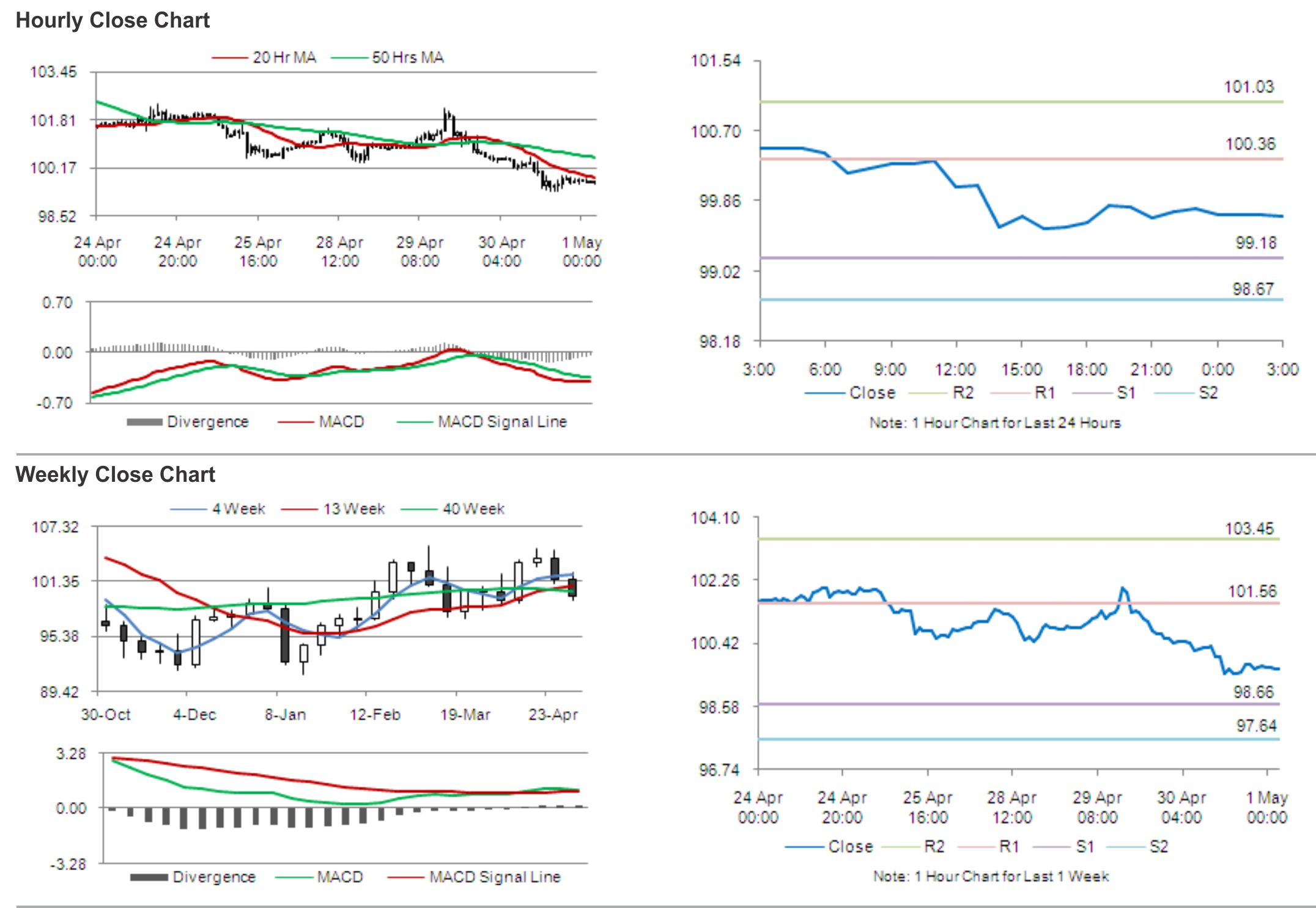

Crude oil is expected to find support at 99.18, and a fall through could take it to the next support level of 98.67. Crude oil is expected to find its first resistance at 100.36, and a rise through could take it to the next resistance level of 101.03.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.