For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.3869, in a quiet holiday trading session. However, later during the day, the US Dollar benefitted from data that showed the ISM manufacturing PMI in the US rose to a four-month high reading of 54.9 in April and that US consumer spending advanced more-than-expected 0.9% (MoM), the fastest pace of rise in nearly five years in March. Likewise, personal income in the US also rose 0.5% (MoM) and surpassed market estimates for a rise of 0.4% but US construction spending failed to meet analysts’ expectations in March. Separately, the US Department of Labor reported that weekly jobless claims unexpectedly climbed by 14,000 to a nine-week high reading of 344,000, last week, while Markit Economics indicated that its final PMI for the US manufacturing sector eased in line with preliminary estimates for April.

Meanwhile, in her speech to community bankers, the US Fed Chief, Janet Yellen assured that the central bank would avoid imposing unnecessary rules on small banks even as it remains vigilant about the impact of big banks on the nation’s financial system. Furthermore, she indicated that, “after several years of reduced lending, following the recession, the economy is starting to see slow but steady loan growth at community banks,” which according to her is an “encouraging sign of an improving economy.”

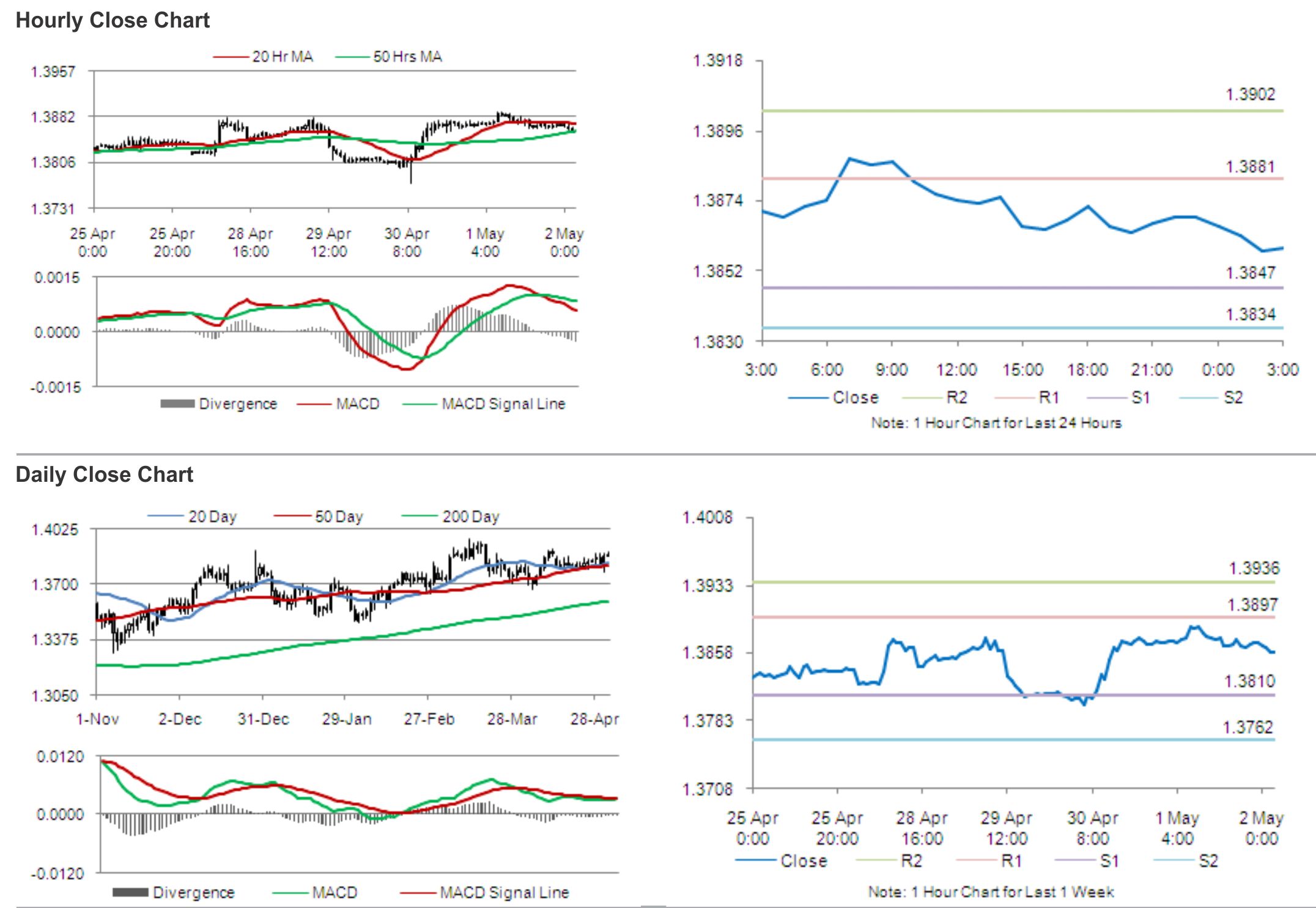

In the Asian session, at GMT0300, the pair is trading at 1.3859, with the EUR trading 0.07% lower from yesterday’s close.

The pair is expected to find support at 1.3847, and a fall through could take it to the next support level of 1.3834. The pair is expected to find its first resistance at 1.3881, and a rise through could take it to the next resistance level of 1.3902.

Later today, traders would eye Euro-zone’s unemployment rate data and Markit manufacturing PMI report for the Euro-zone and its member nations.

The currency pair is trading just below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.