For the 24 hours to 23:00 GMT, Gold rose 1.39% against the USD and closed at 1199.90, as a broad decline in global equity markets and the greenback enhanced the demand outlook of the yellow metal.

The US Mint reported that purchase of American Eagle gold coins fell 39% to 524,500 ounces in 2014, the largest drop since 2006, as compared to 856,500 ounces reported in the previous year.

The SPDR Gold Trust showed that gold holdings in the exchange traded fund fell to 710.81 metric tons yesterday, the lowest level recorded in more than six years. Meanwhile, the World Gold Council projected central banks all over the world to purchase around 400 tons to 500 tons of gold in 2014, from last year’s 409.3 tons.

In the Asian session at 4:00GMT, gold is trading at USD 1201.50 per ounce, 0.13% higher from 23:00GMT.

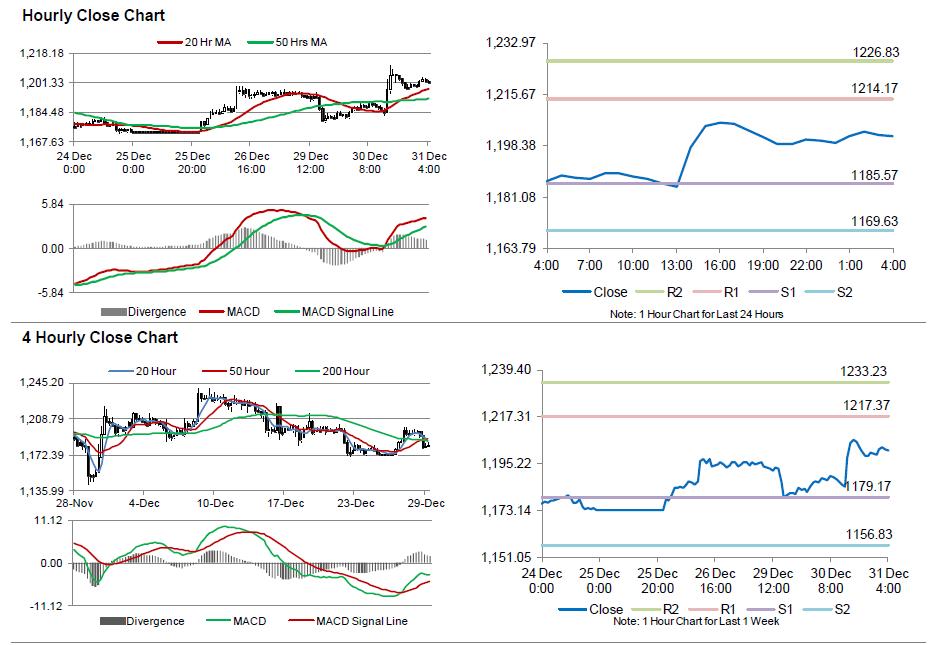

The pair is expected to find support at 1185.57, and a fall through could take it to the next support level of 1169.63. The pair is expected to find its first resistance at 1214.17, and a rise through could take it to the next resistance level of 1226.83.

The yellow metal is trading above its 20 Hr and 50 Hr moving averages.